In today’s complex financial environment, community bank C-suite executives require more than just a traditional management platform—they demand a solution that delivers actionable, granular insights across every facet of operations.

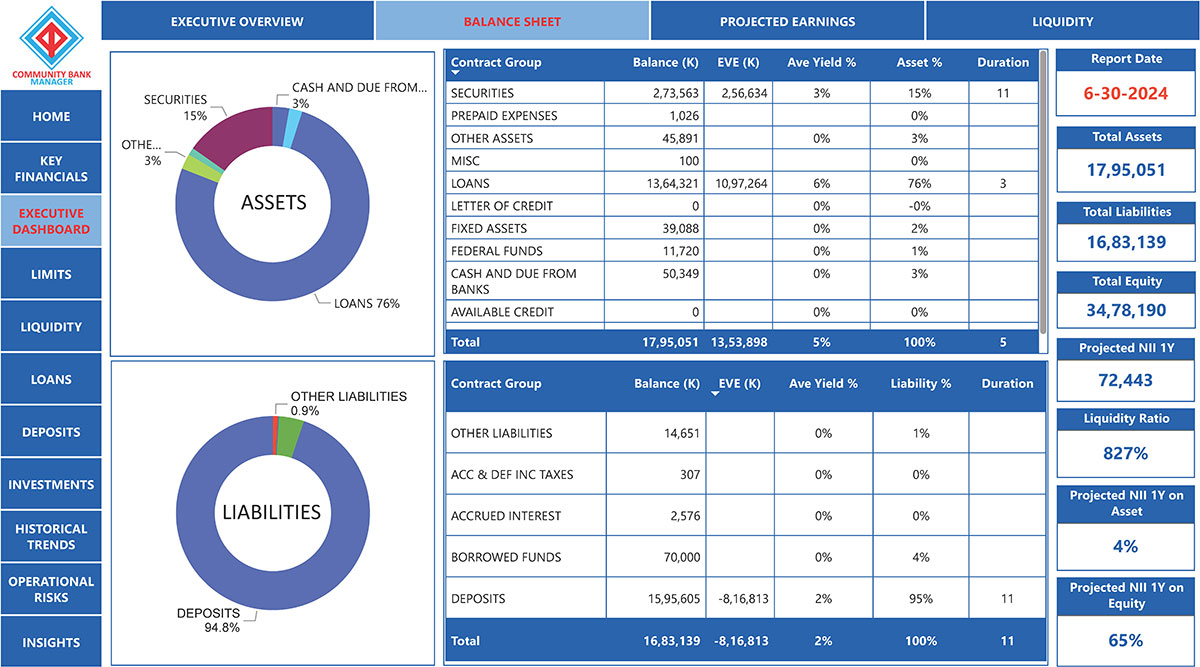

CBALM

COMPREHENSIVE ALM PLATFORM WITH BOARD REPORTING

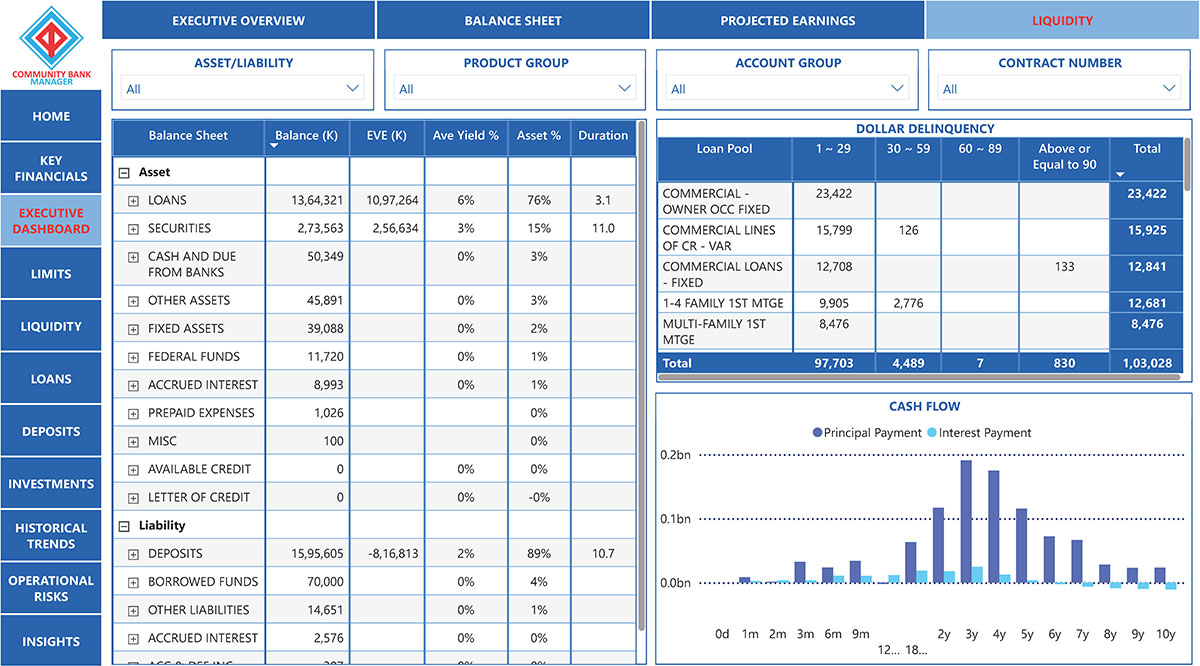

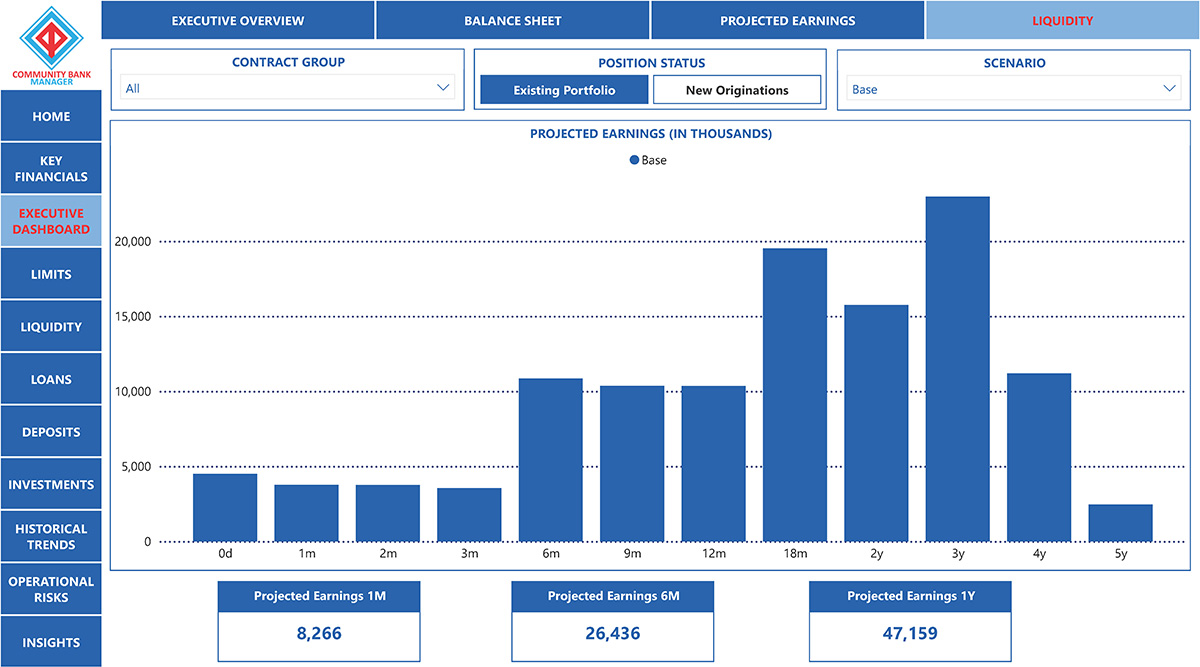

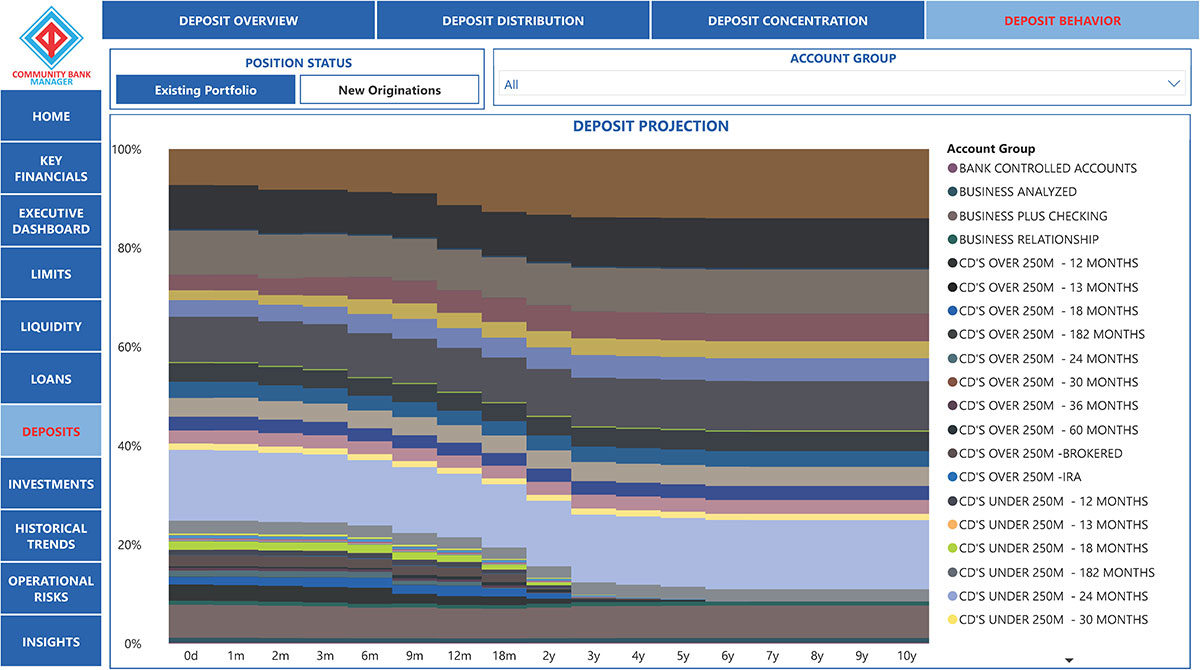

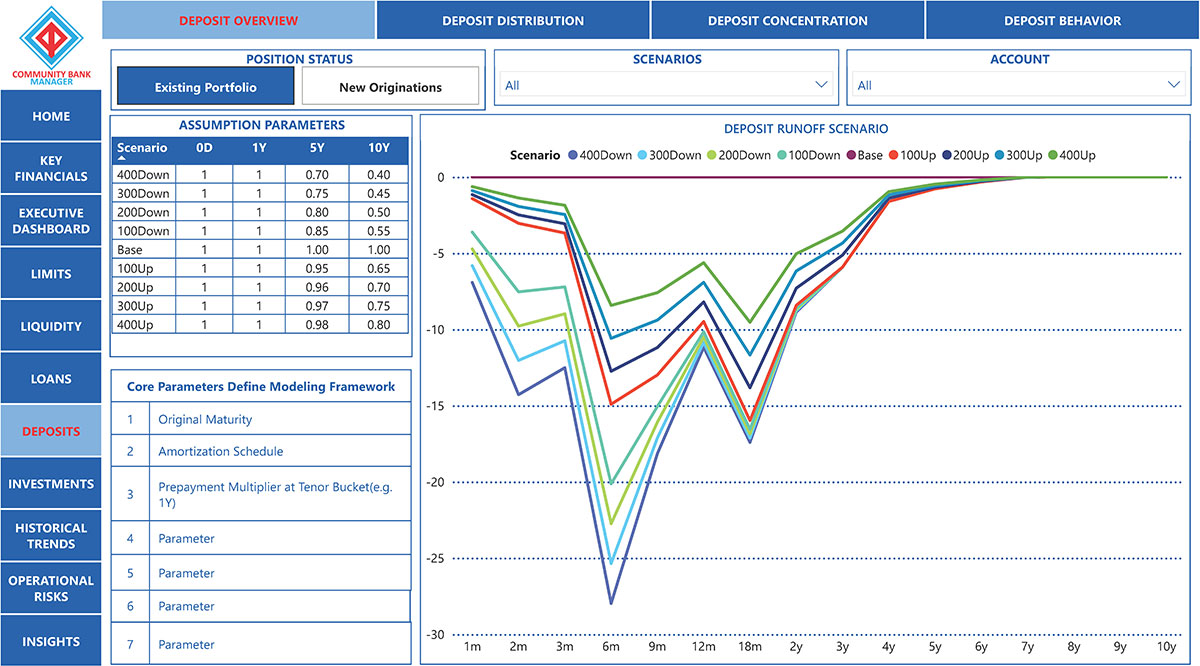

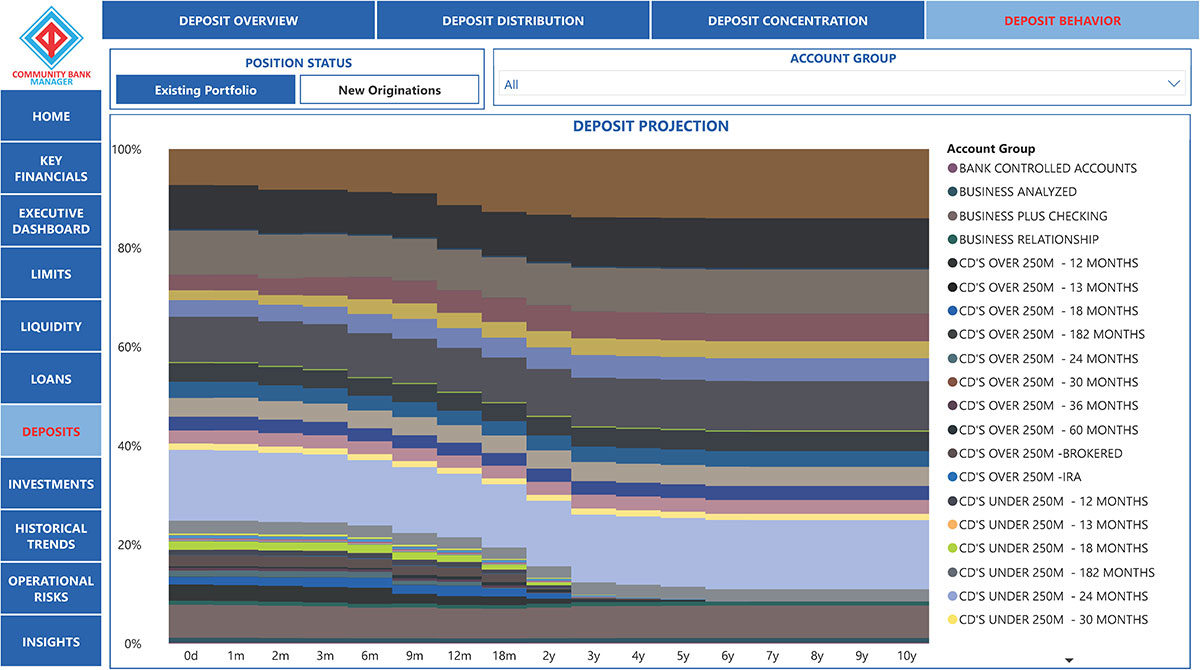

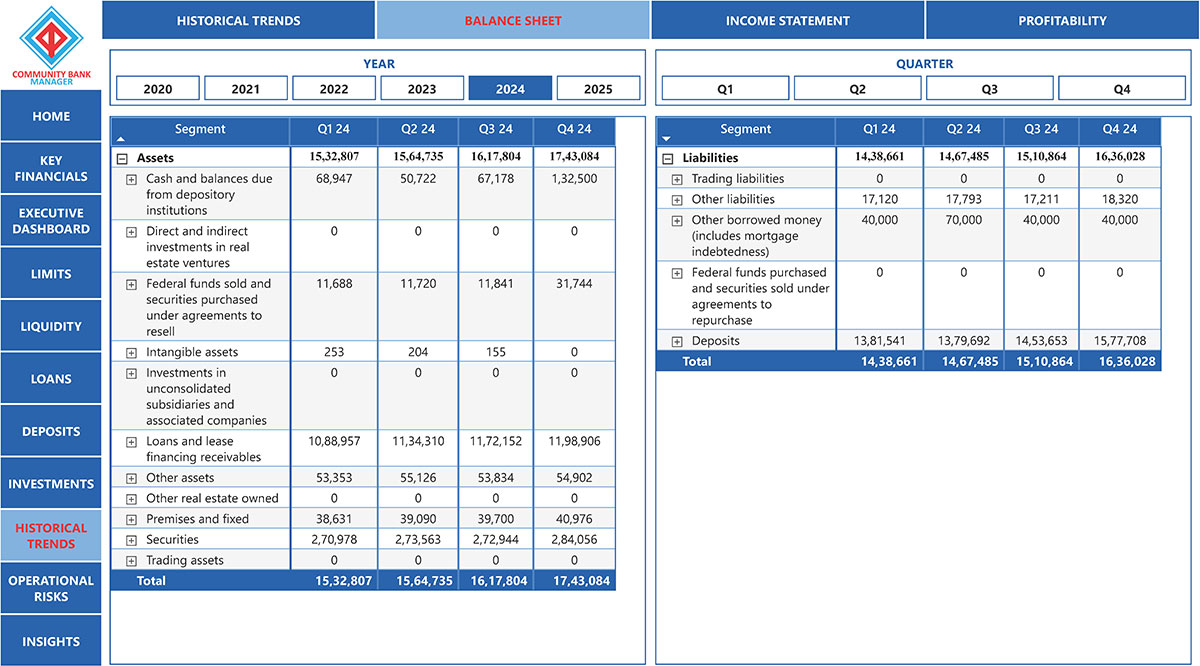

- Offers a comprehensive ALM framework with built-in board reporting tools

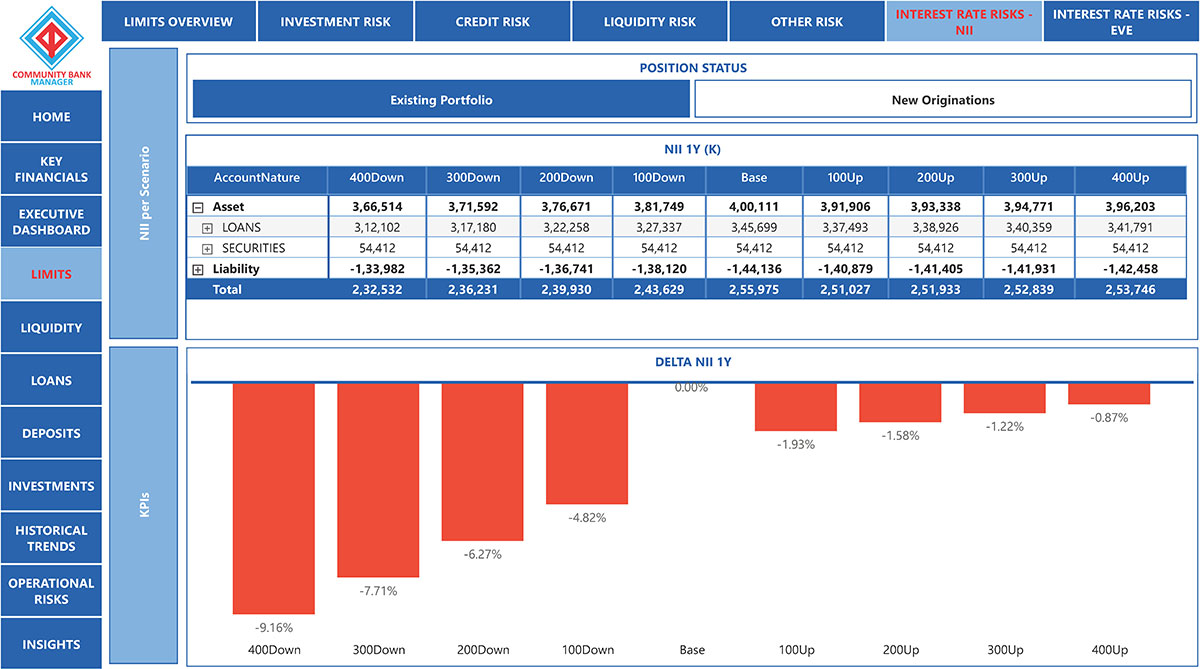

- Enables scenario-based modeling across economic and rate environments

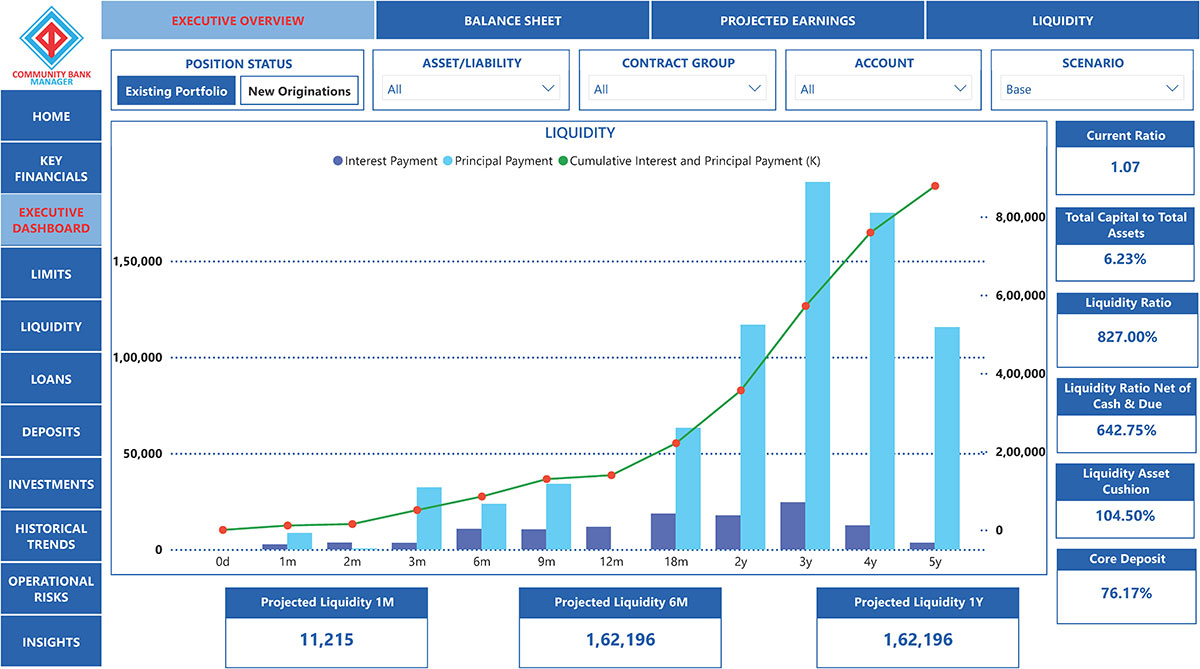

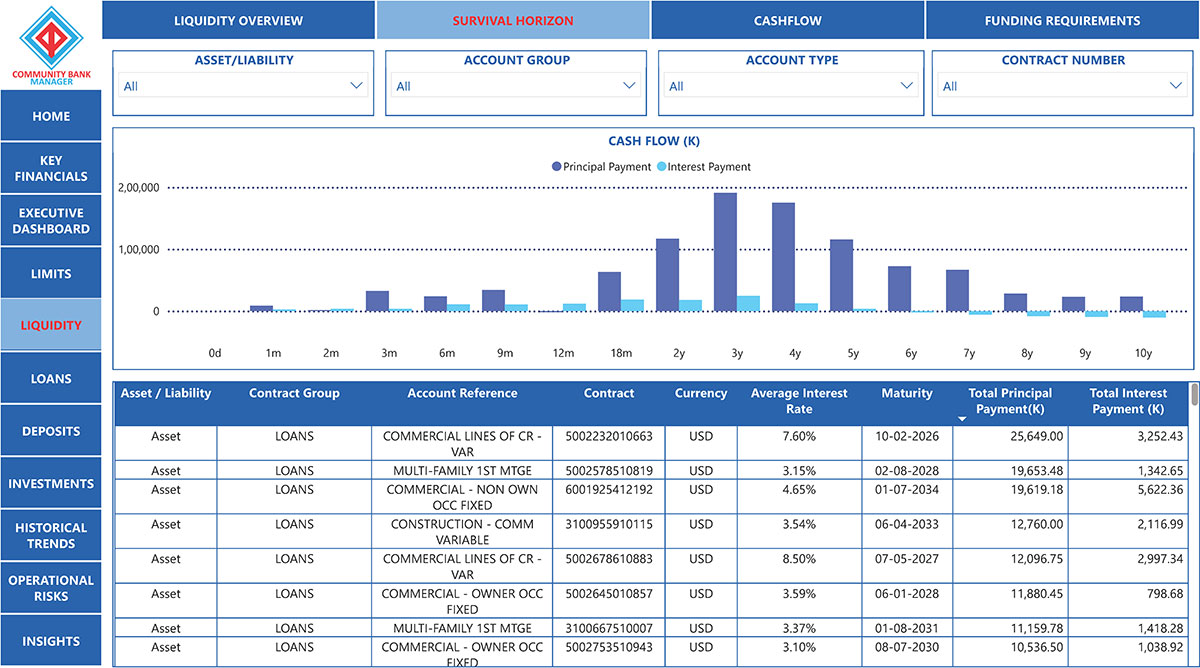

- Assesses liquidity risk and interest rate sensitivity in real time

- Supports stress testing for both short- and long-term strategic plans

- Visualizes net interest margin dynamics and balance sheet evolution

- Incorporates customized forecasting assumptions and shock analysis

- Aligns risk exposures with organizational objectives and thresholds

- Streamlines reporting workflows for board, auditors, and regulators

- Enhances capital planning with forward-looking risk metrics

- Provides transparency across funding sources and maturity profiles

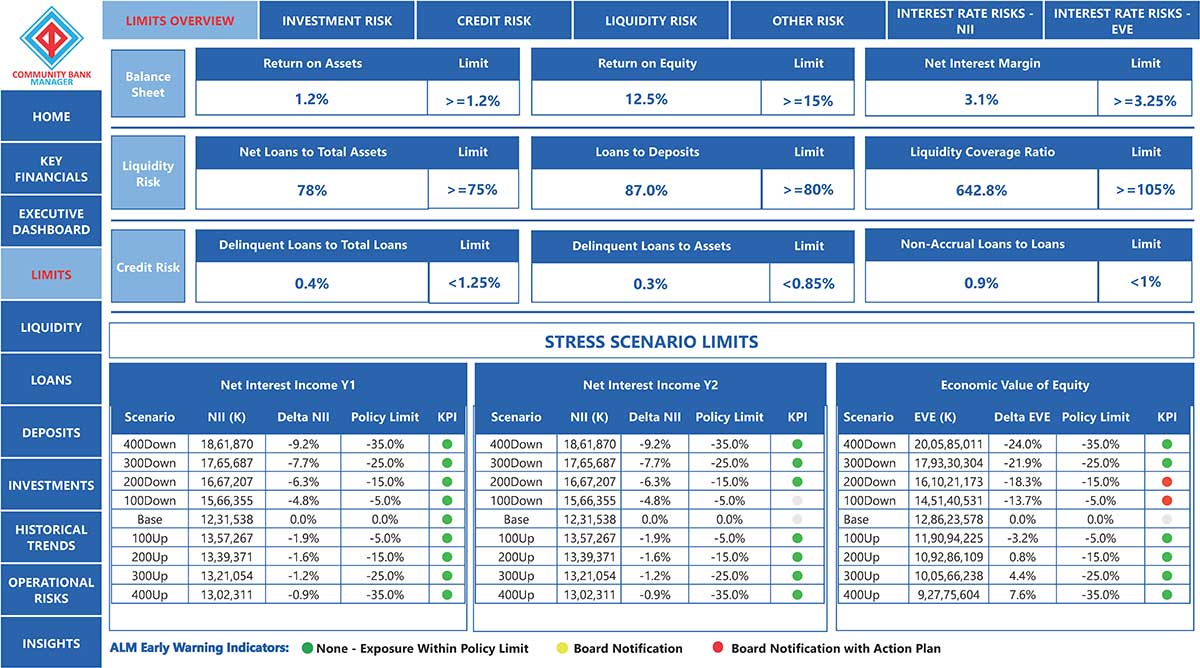

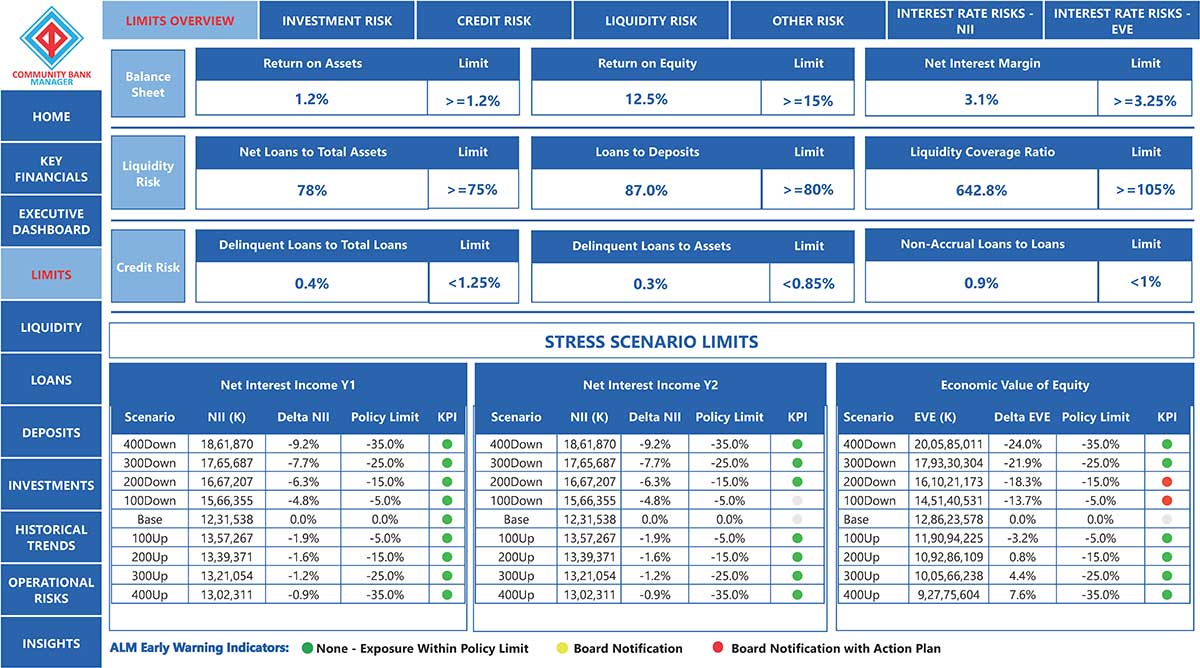

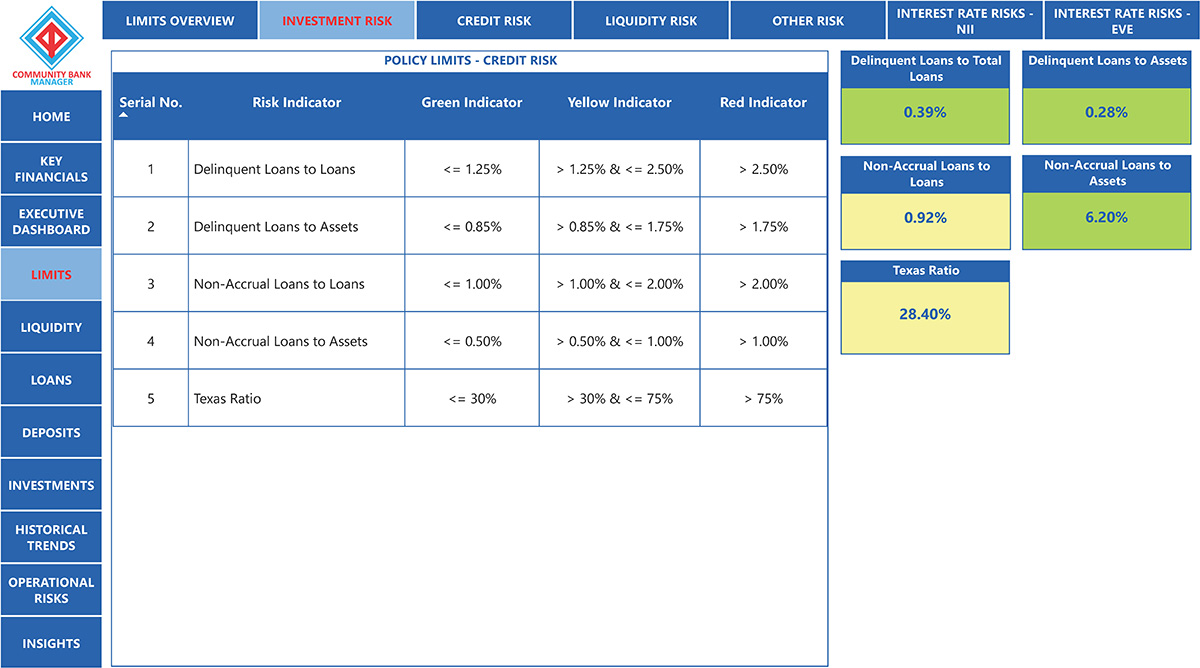

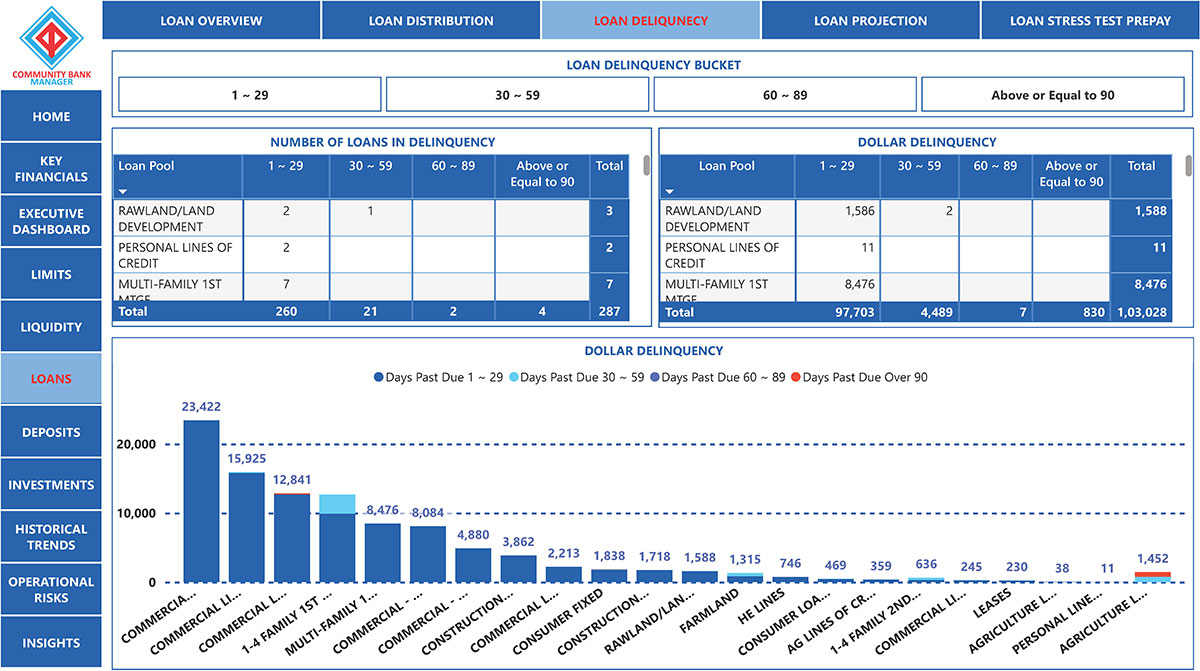

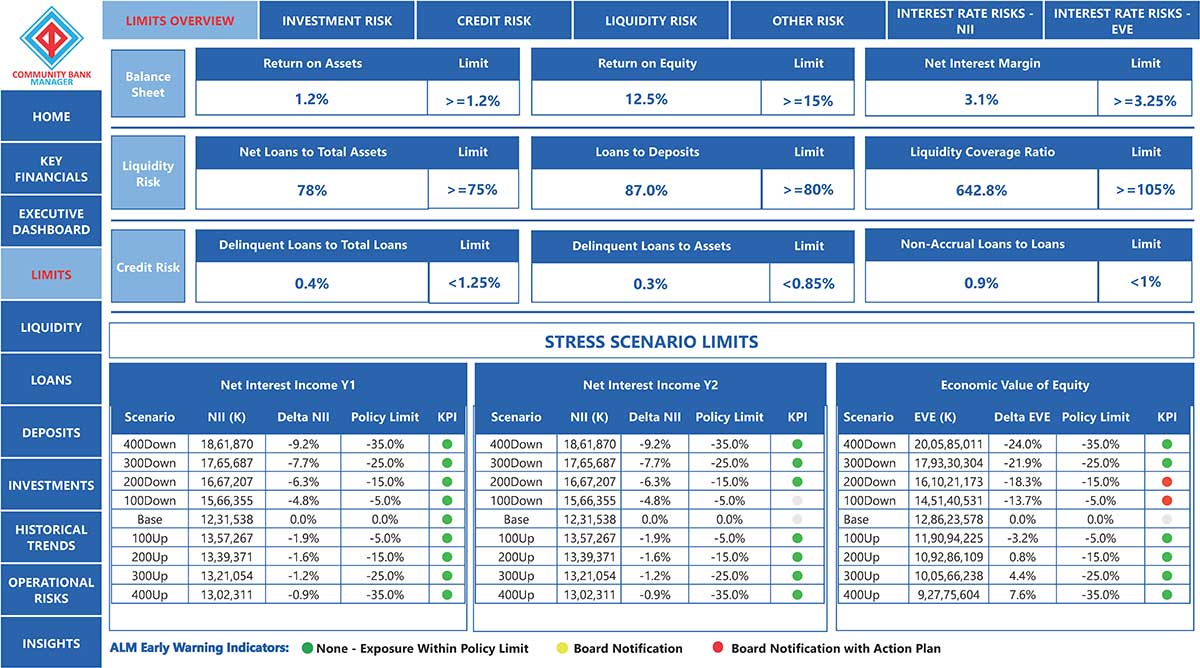

CBLIMITS

LIMIT MANAGEMENT SYSTEM

- Manages lending thresholds across segments, tiers, and regions

- Automates alerts for limit breaches and exceptions

- Ensures compliance with internal policy and regulatory guidelines

- Tracks exposure levels by borrower category and product type

- Delivers audit-ready documentation for governance transparency

- Links directly with origination and approval platforms

- Enables strategic portfolio steering based on risk tolerance

- Facilitates reviews and updates to limit structures and controls

- Incorporates dashboards for oversight across management layers

- Helps balance risk appetite with growth objectives

CECL EXPRESS

RIGOROUS CECL RESERVE COMPUTATION ACROSS ALL METHODS

- Industry’s most powerful and comprehensive platform.

- Intuitive screen design, market data provision, and optimization of expected credit losses.

- All CECL loss methods covered including:

- 1. Weighted average remaining maturity

- 2. Roll Rate

- 3. Discounted cashflow

- 4. Probability of Default/Loss Given Default

- CORE TO BOARDTM reporting package

- Comprehensive model documentation for auditors and examiners

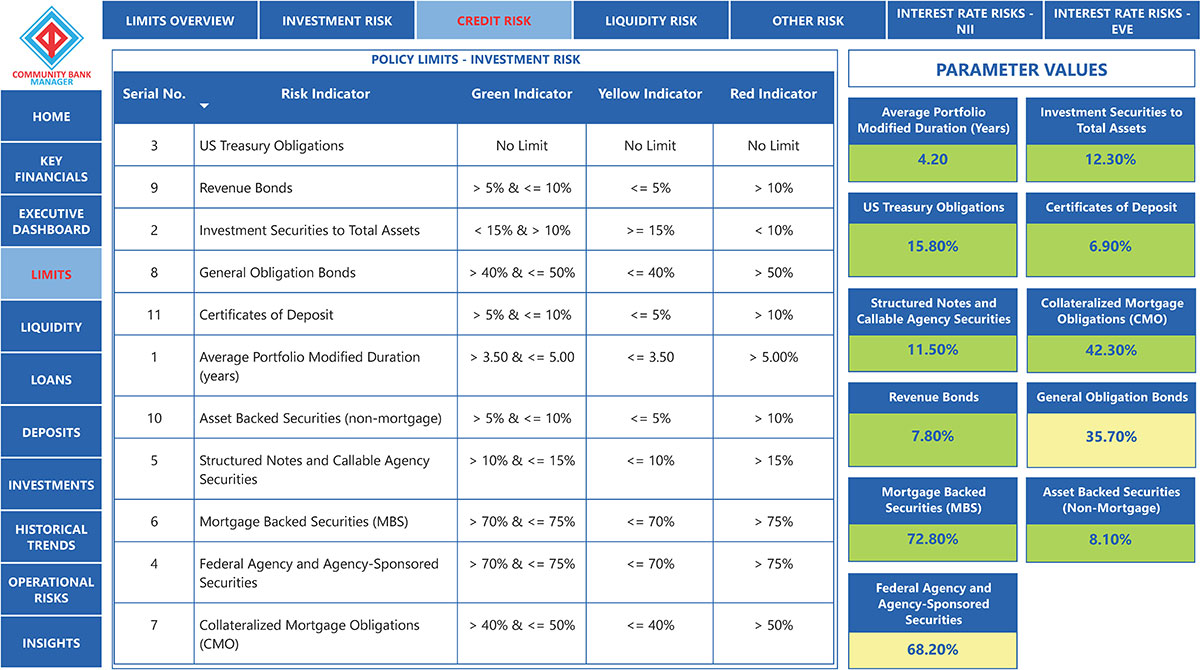

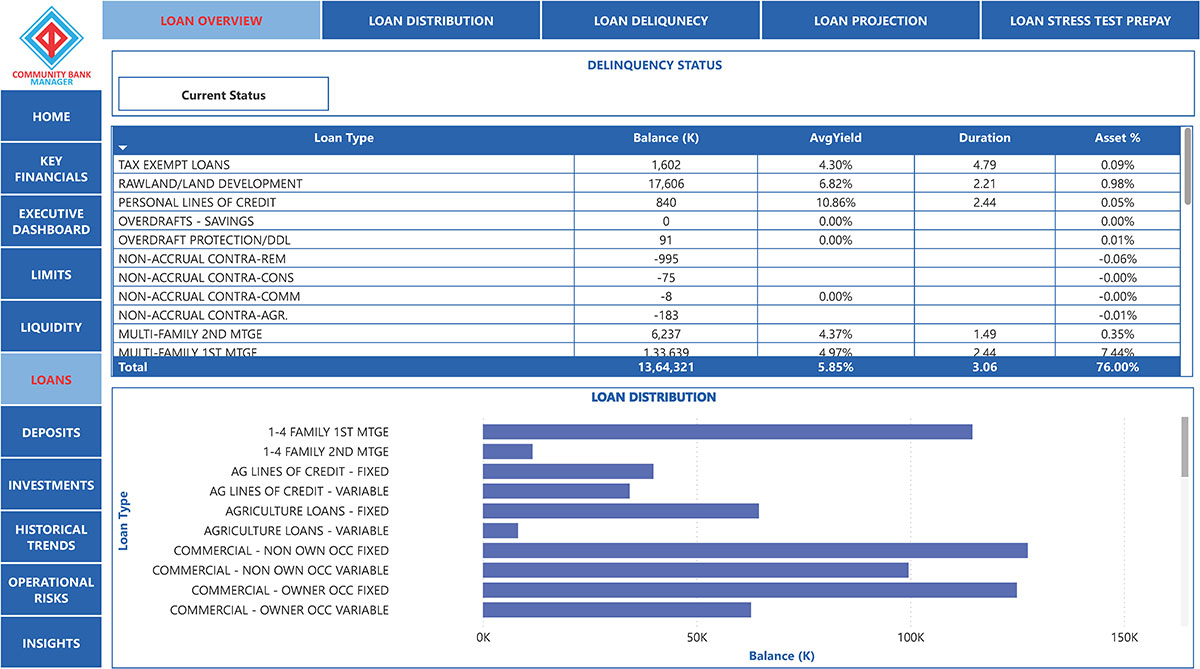

CBINVEST

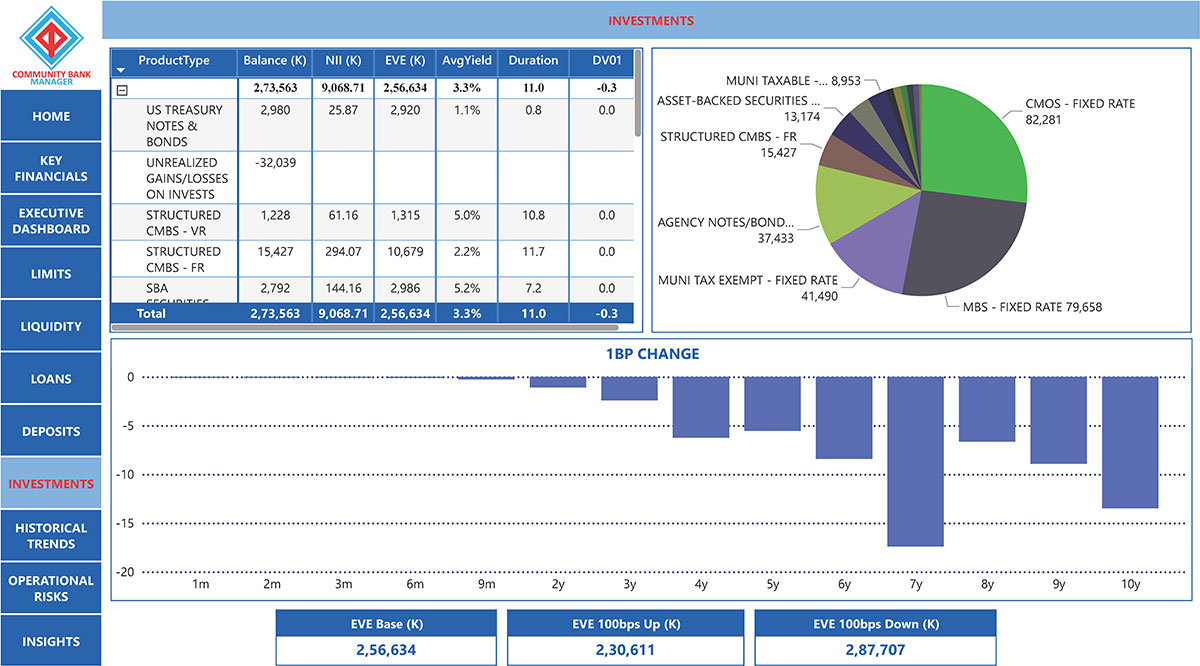

INVESTMENT ANALYSIS AND BOND ACCOUNTING

- Imports broker-provided securities data into interactive dashboards

- Provides real-time performance tracking and yield optimization tools

- Enables what-if analysis prior to purchase or liquidation decisions

- Combines market and portfolio metrics for effective oversight

- Reduces manual entry and spreadsheet errors across reporting cycles

- Aligns investment decisions with strategic objectives and risk limits

- Streamlines quarterly data ingestion and historical performance review

- Enhances reporting accuracy with consolidated views of asset classes

- Supports compliance validation against permissible investment rules

- Critical for navigating market volatility and capital allocation

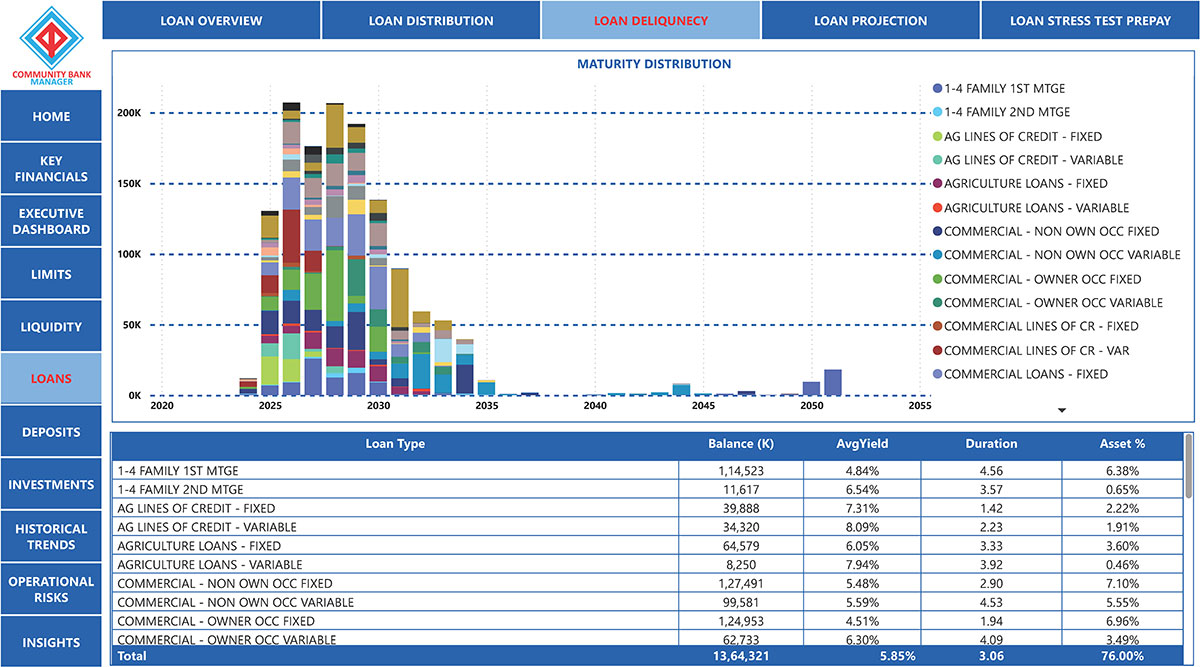

CBPLAN

SECNARIO PLANNING AND BUDGETING PLATFORM

- Provides a flexible platform for economic, rate, and behavioral modeling

- Supports unlimited variables and scenario creation

- Tracks progress across daily, monthly, quarterly, and annual intervals

- Incorporates granular expense and revenue line-item forecasts

- Imports scenario outputs directly into board and executive packages

- Adapts to organizations of any size with tactical scalability

- Facilitates strategic planning and what-if simulation workflows

- Aligns budgets with operational goals and external market conditions

- Offers collaborative input capabilities for cross-functional teams

- Maintains a secure, centralized repository for plan versions

CBONE

ONE SOURCE DATA STORAGE AND RETRIEVAL

- Centralizes financial, loan, and performance data across systems

- Provides continuous syncing with core and loan platforms

- Stores up to 10 years of historical data for trend analysis

- Enhances team collaboration via version control and live updates

- Simplifies data sharing among management, boards, and auditors

- Eliminates fragmented spreadsheet workflows and manual updates

- Improves data integrity and reduces reporting errors

- Secures access with role-based permissions and audit tracking

- Streamlines analytics by unifying data under one platform

- Delivers real-time visibility into organizational performance

CBREG

AUTOMATED CALL REPORTS AND NCUA EXAMINER PACKAGES

- Automates creation of examiner-ready information packages

- Extracts data directly from internal systems into compliance templates

- Incorporates feedback and follow-ups from previous exams

- Aligns with regulatory guidelines and best practice standards

- Supports one-click generation of reporting documents

- Reduces time spent preparing examination materials

- Enhances transparency for auditors and supervisory teams

- Allows integration of management narratives and qualitative insights

- Tracks past findings to improve future exam readiness

- Enables cross-referencing with regulatory comment databases

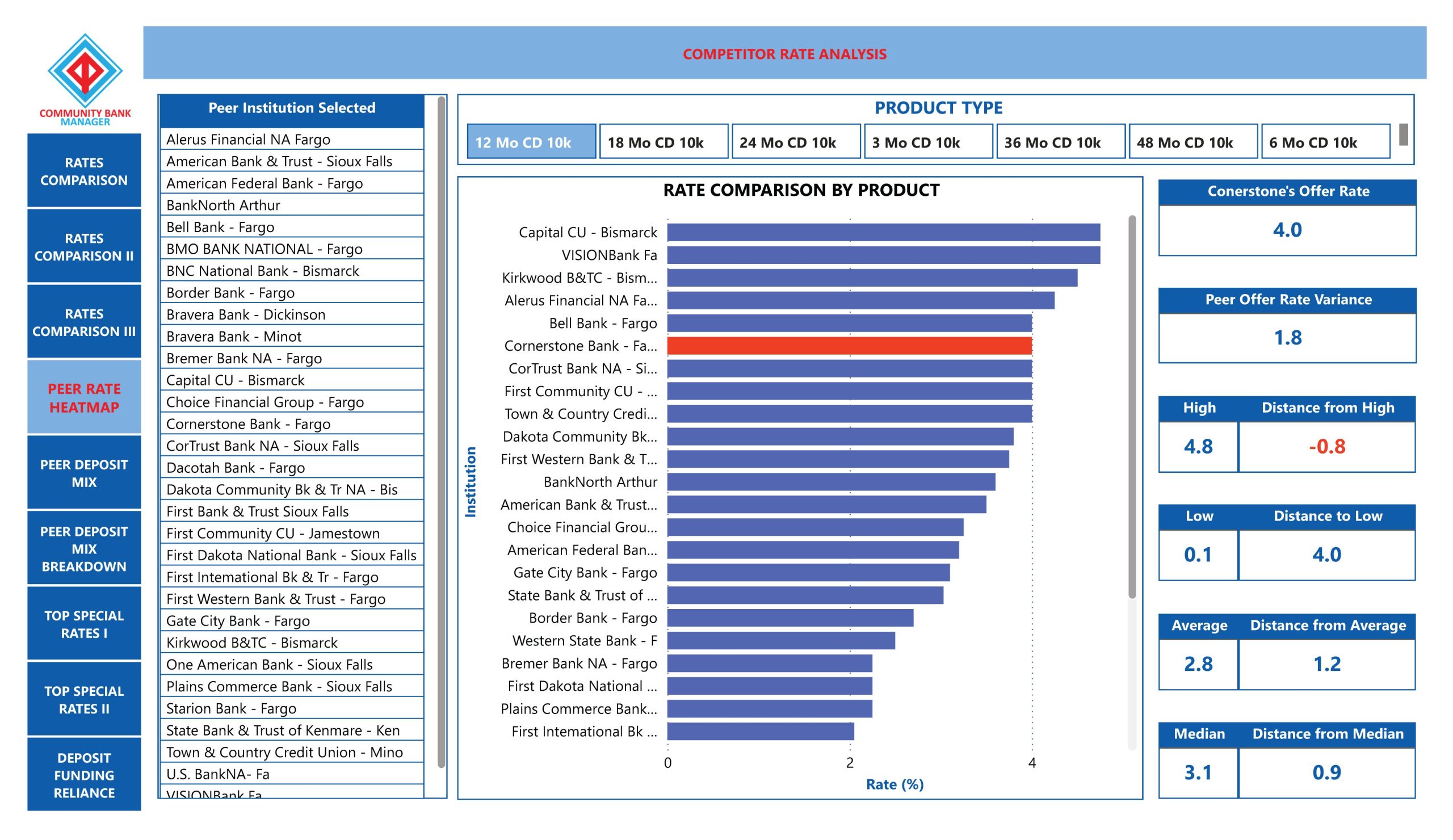

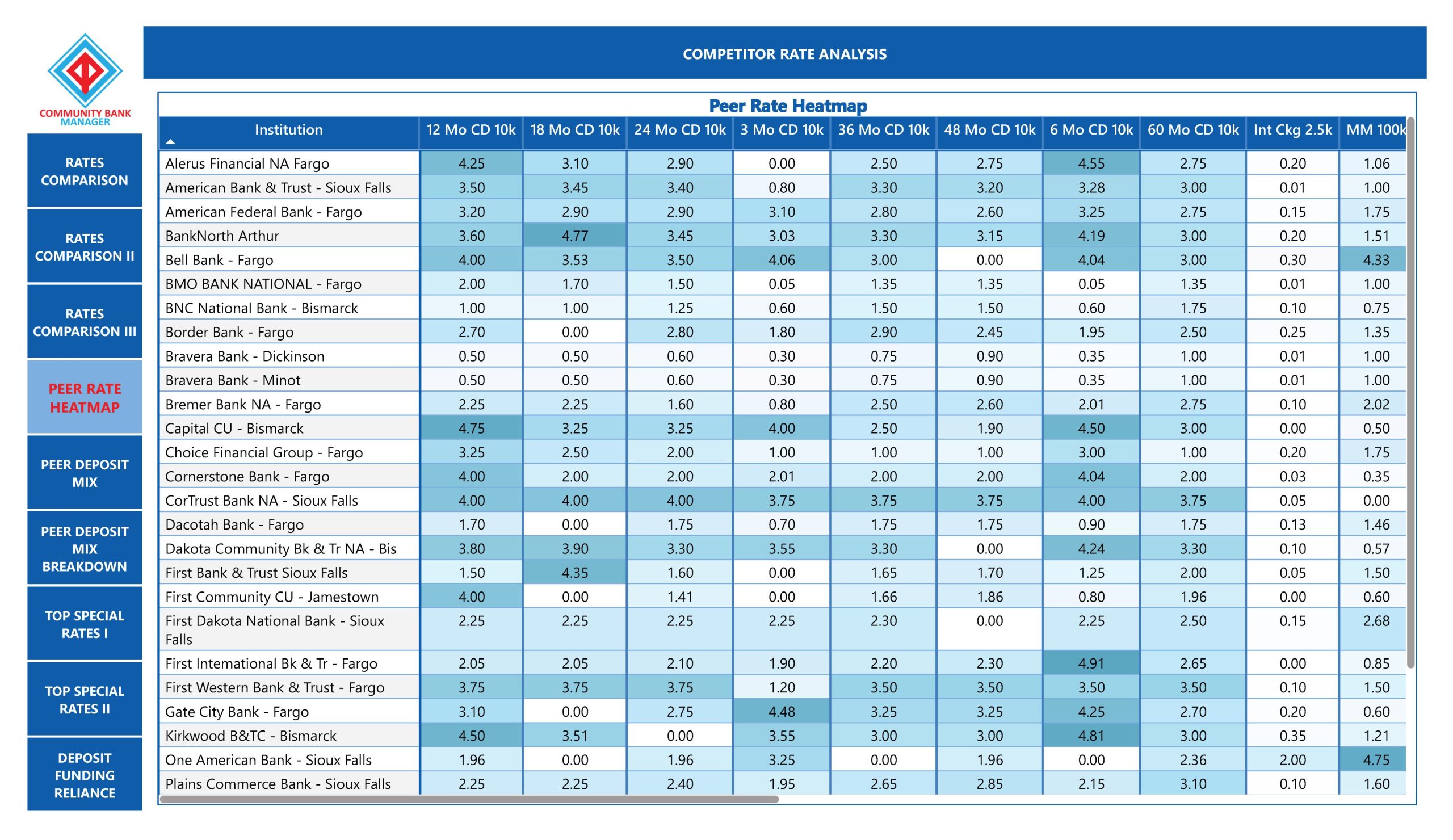

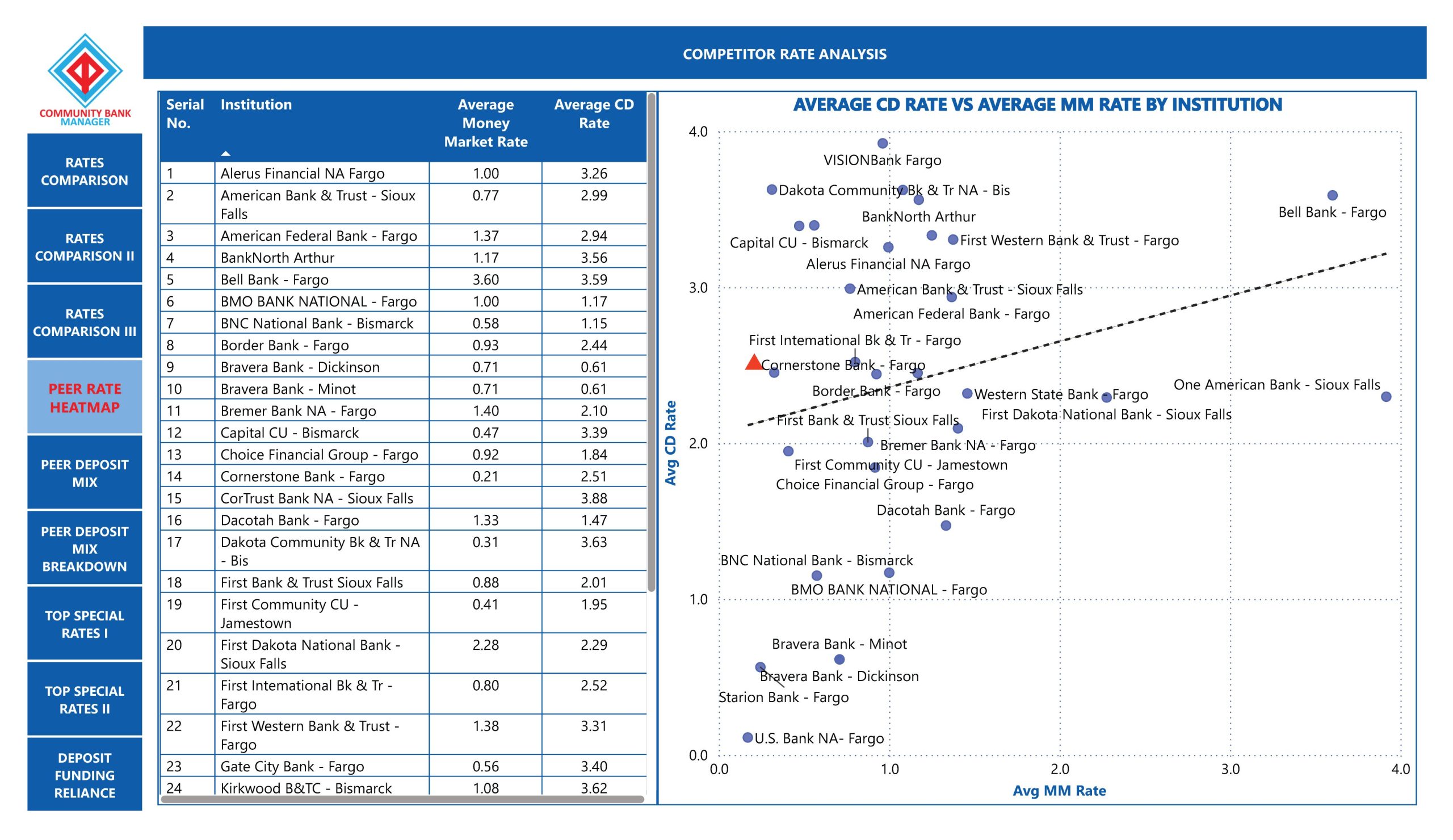

CBPEER

PEER RATES AND PERFORMANCE ANALYSIS

- Integrates public industry data for competitive benchmarking

- Maps peer metrics into internal planning and reporting workflows

- Delivers insights on rates, returns, and operational performance

- Provides customizable dashboards for trend tracking and analysis

- Enables side-by-side comparisons with similar institutions

- Supports strategic planning with peer-aligned performance goals

- Incorporates peer benchmarks into board and examiner packages

- Highlights strengths and gaps relative to industry norms

- Updates regularly with market shifts and new peer data

- Offers visual summaries for executive interpretation

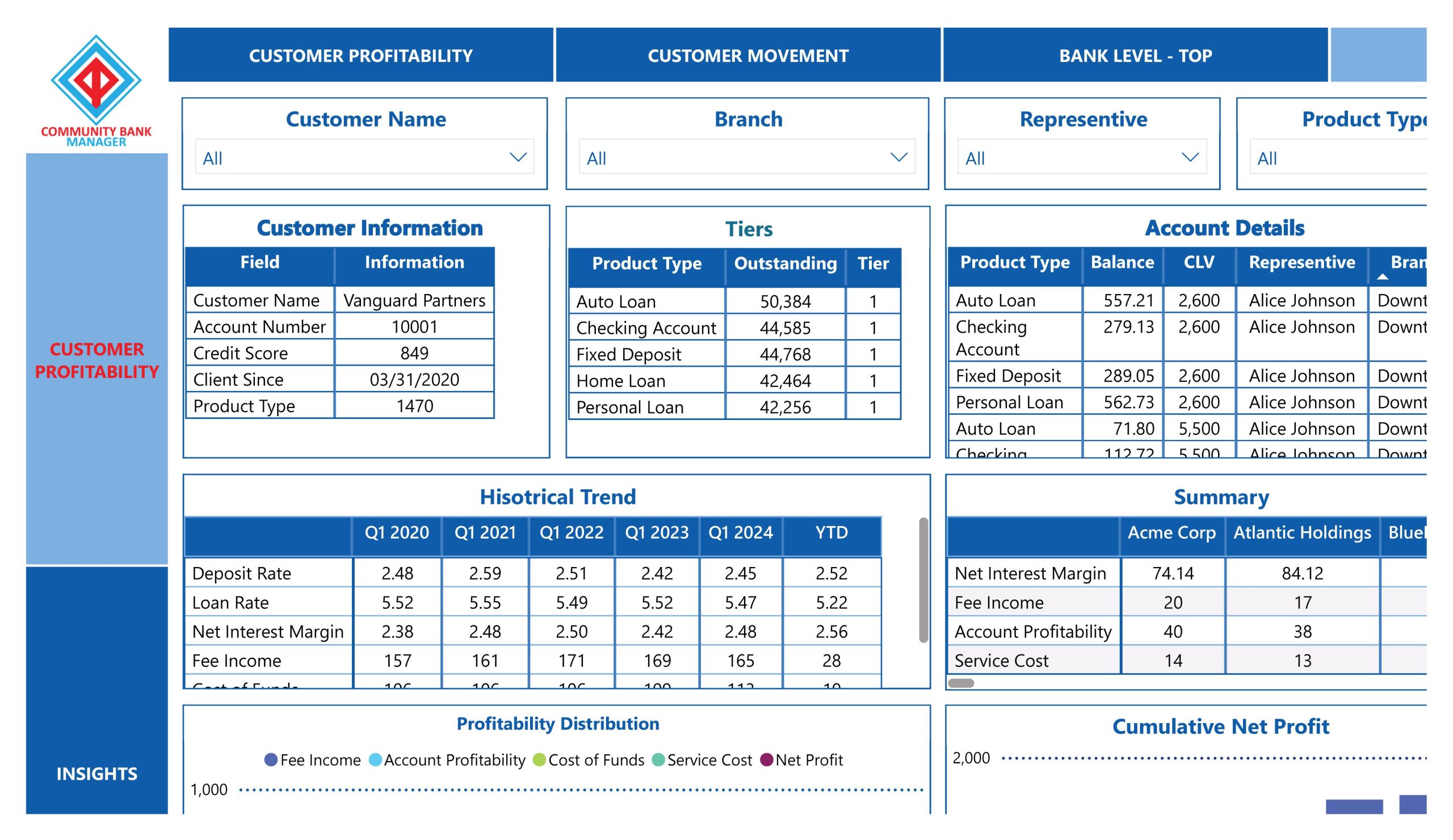

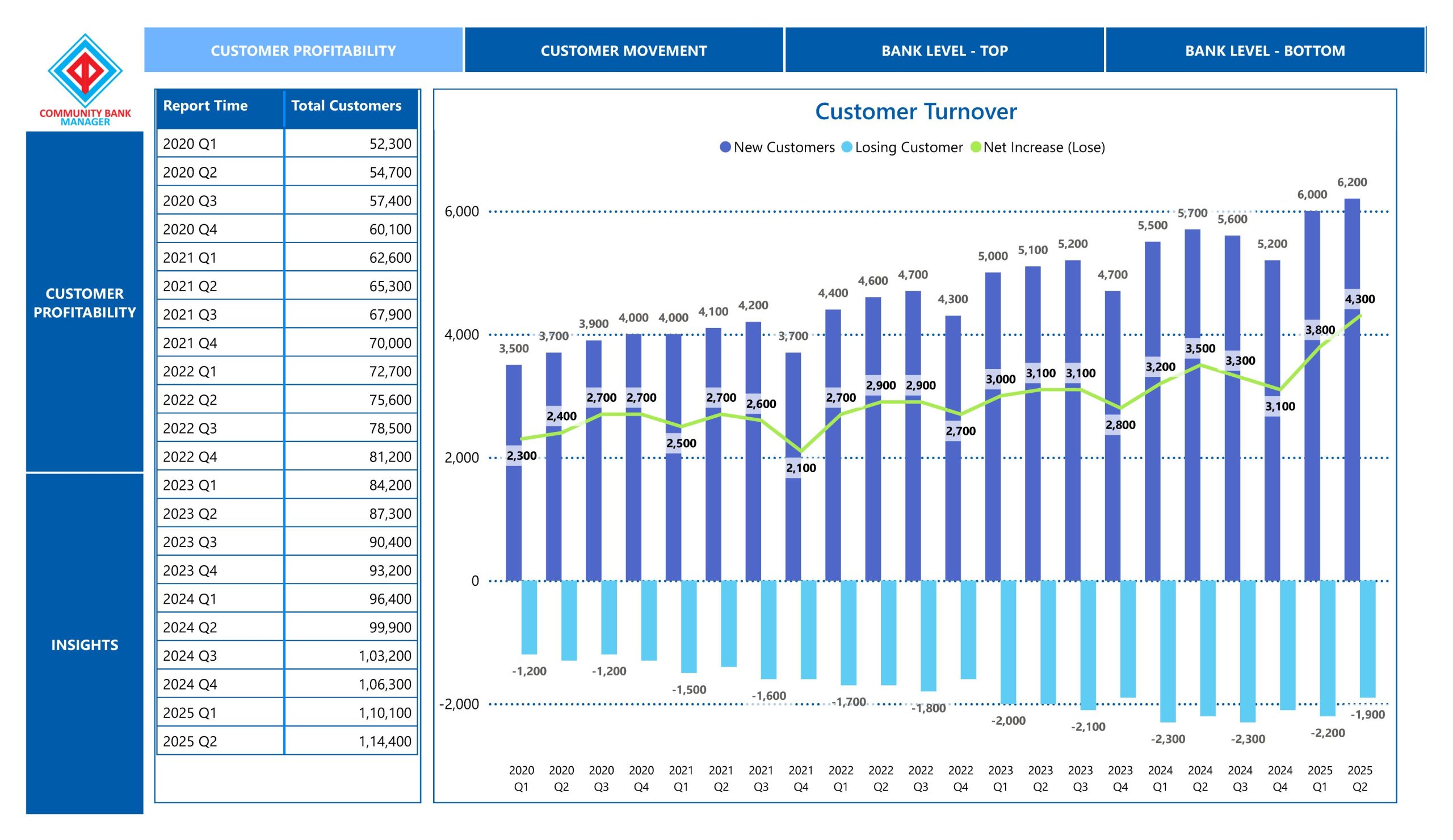

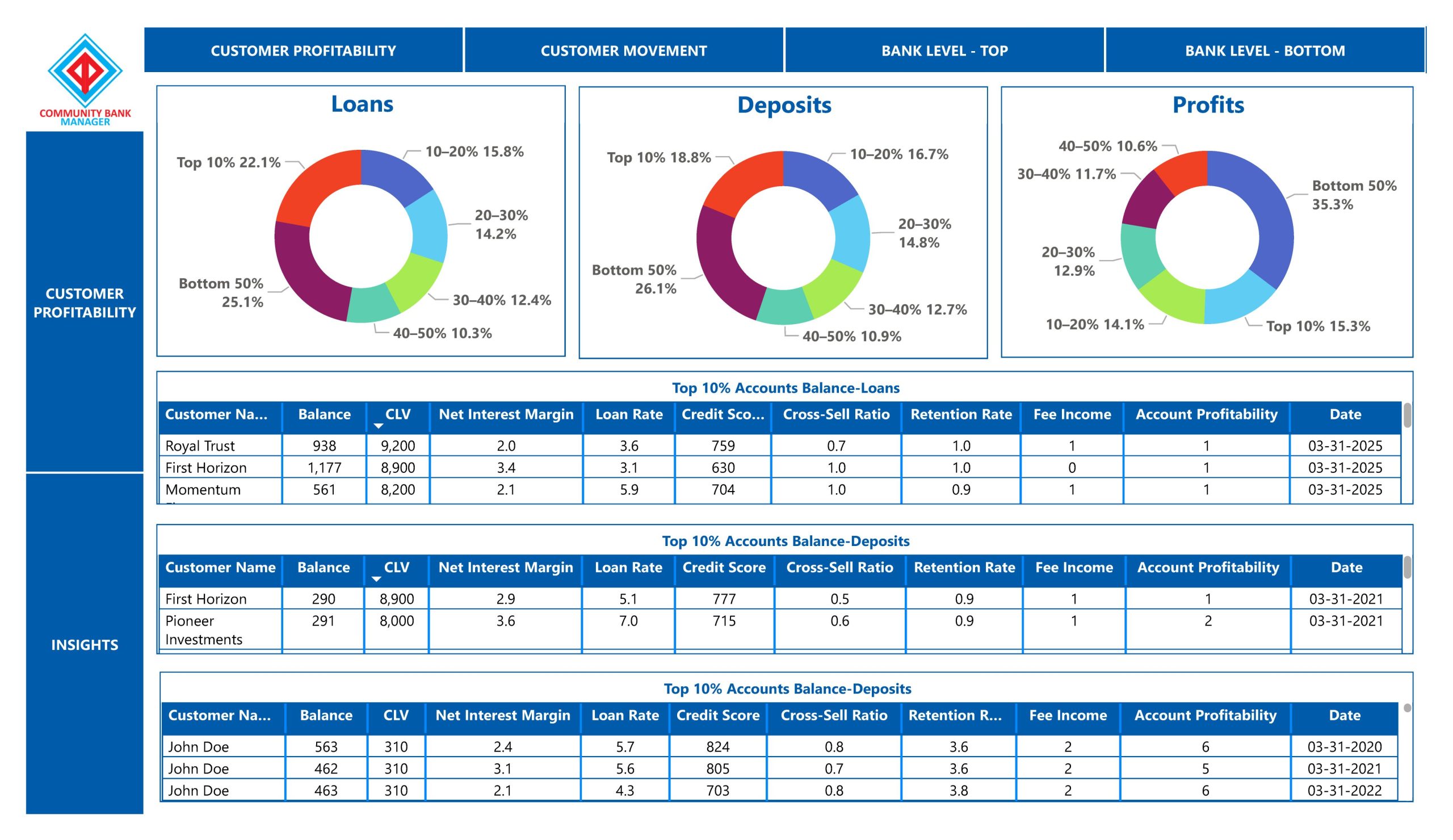

CBCLIENT

CLIENT PROFITABILITY

- Segments client data by relationship value and revenue contribution

- Calculates profitability metrics using customizable cost drivers

- Visualizes client retention, growth, and revenue trends

- Assists in strategic pricing and service tier decisions

- Highlights high-value relationships for targeted outreach

- Maps profitability by product, channel, or segment

- Links financial outcomes with operational and service inputs

- Tracks changes in client behaviour over time

- Enables scenario modelling to project future relationship value

- Supports alignment with overall business strategy

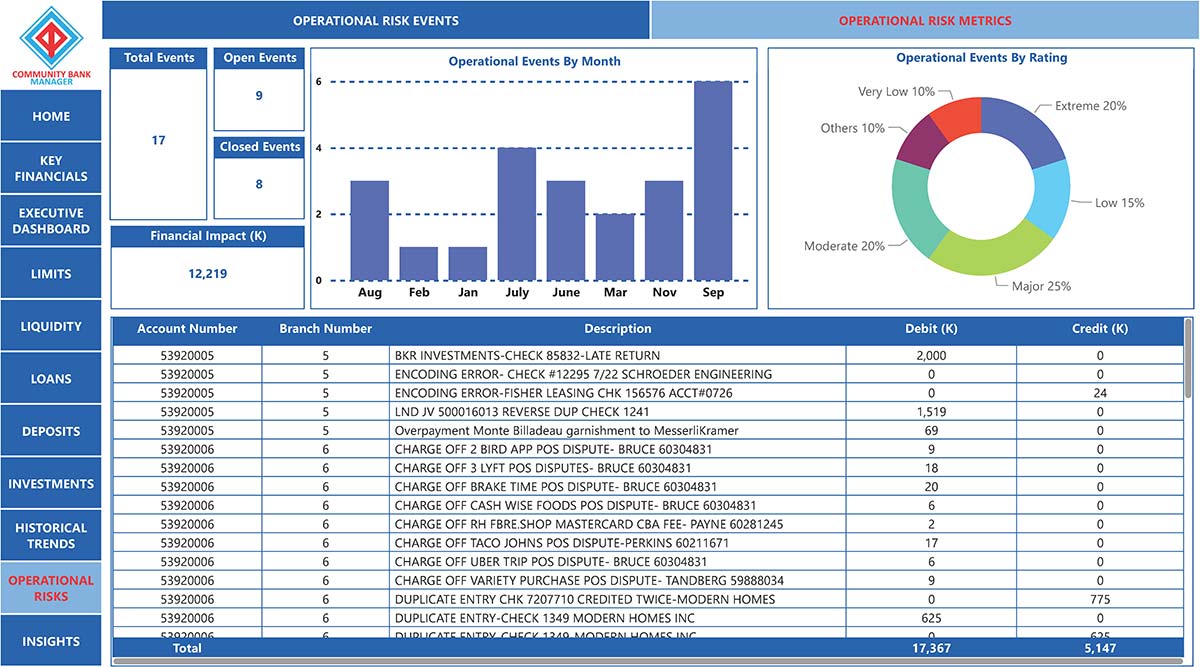

CBOPS

OPERATIONAL RISK MANAGEMENT

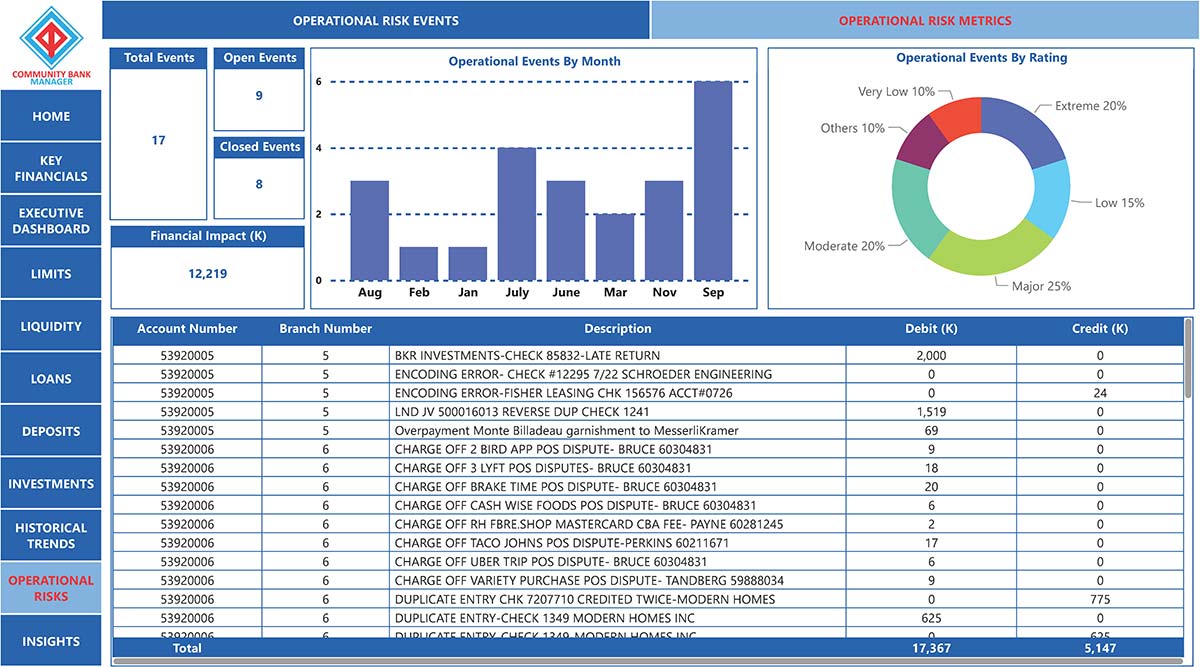

- Identifies and tracks process, systems, and human-related risks

- Provides a centralized risk register with categorization workflows

- Flags risk exposures by severity, likelihood, and control status

- Supports scenario modeling to assess operational resilience

- Links risk events to mitigation actions and responsible teams

- Enables historical tracking for trend analysis and audit readiness

- Integrates key metrics into performance dashboards

- Facilitates real-time updates and incident logging

- Helps establish thresholds for operational stability

- Aligns with broader enterprise risk and compliance frameworks

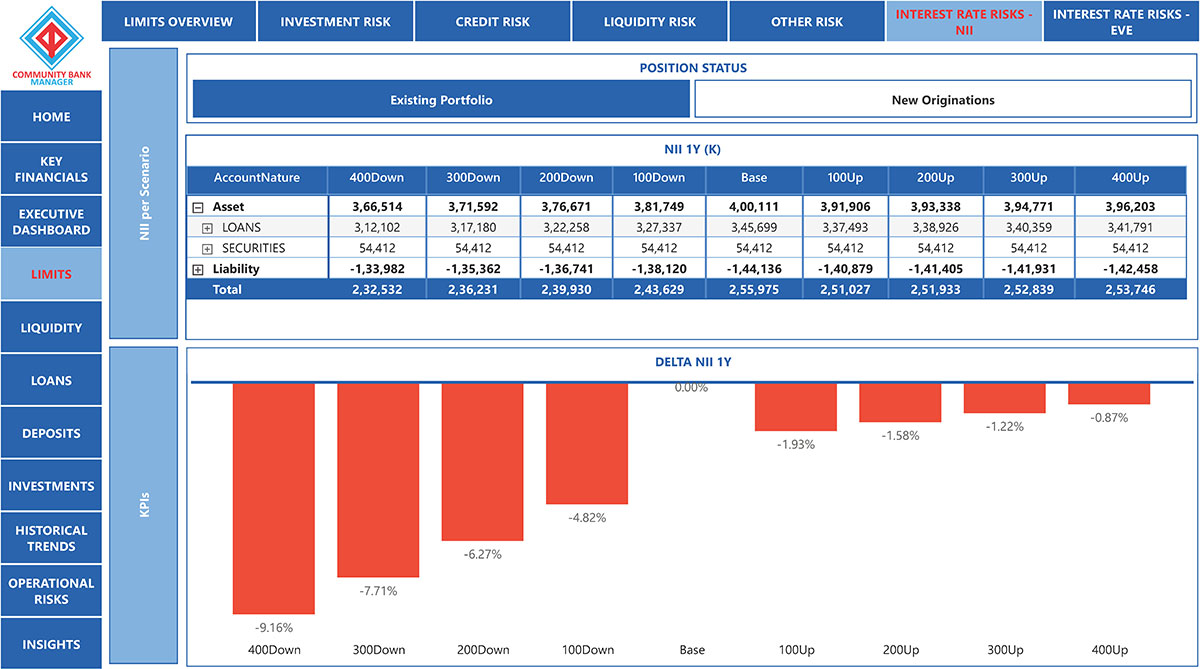

CBRISK

UNIVERSAL RISK MANAGEMENT SYSTEM

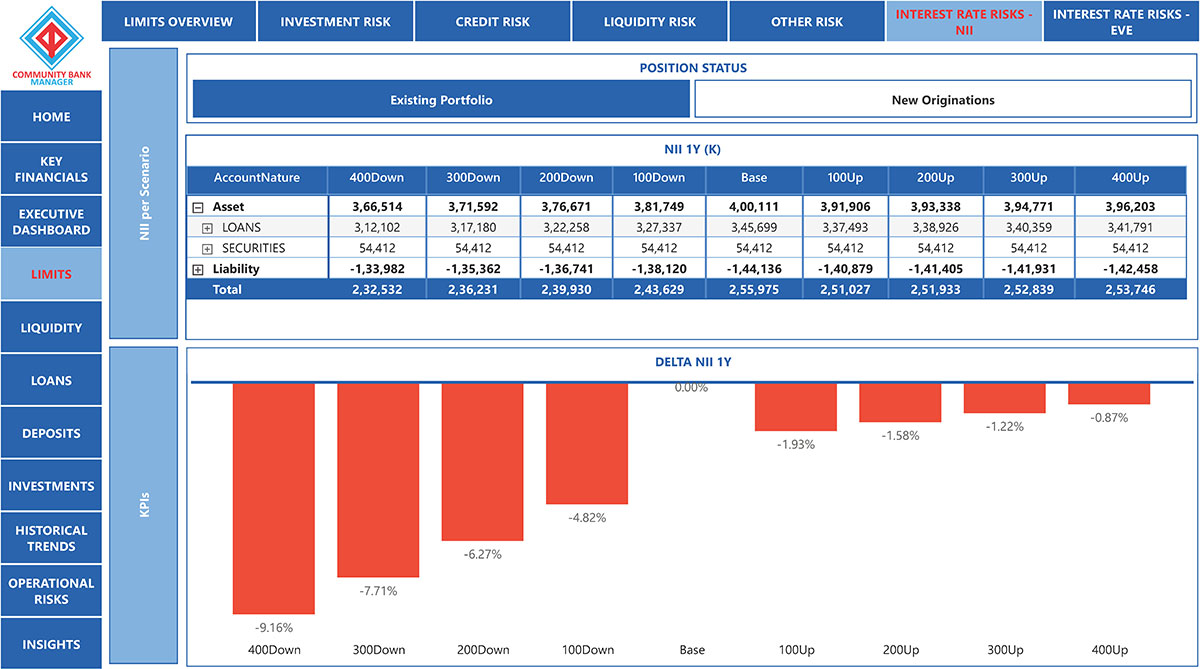

- Quantifies strategic and board-level risk limits across scenarios

- Maps limits into dashboards with color-coded alerts (green, orange, red)

- Tailors modeling to specific risk frameworks and thresholds

- Displays proximity to risk violations in visual format

- Aligns scenario analysis with interest rate, economic, and business shifts

- Tracks limit adherence under real-time and forecasted conditions

- Enhances board reporting with intuitive risk visualizations

- Links strategic plans to corresponding risk tolerances

- Supports updates to risk frameworks based on evolving conditions

- Improves decision-making with forward-looking risk heatmaps