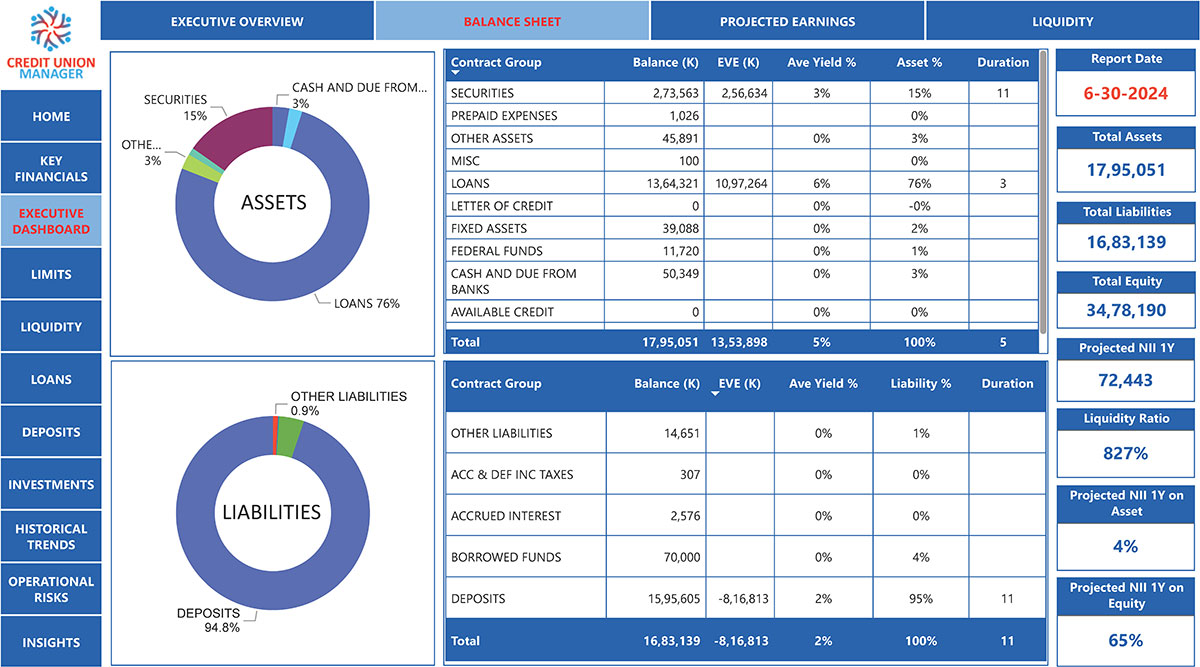

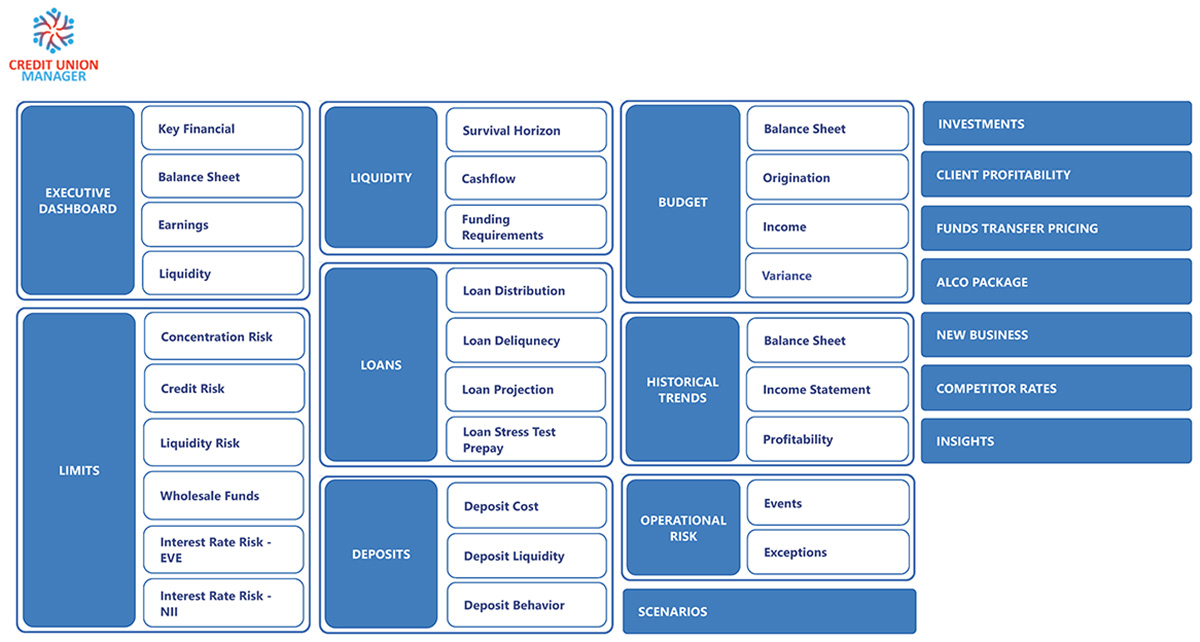

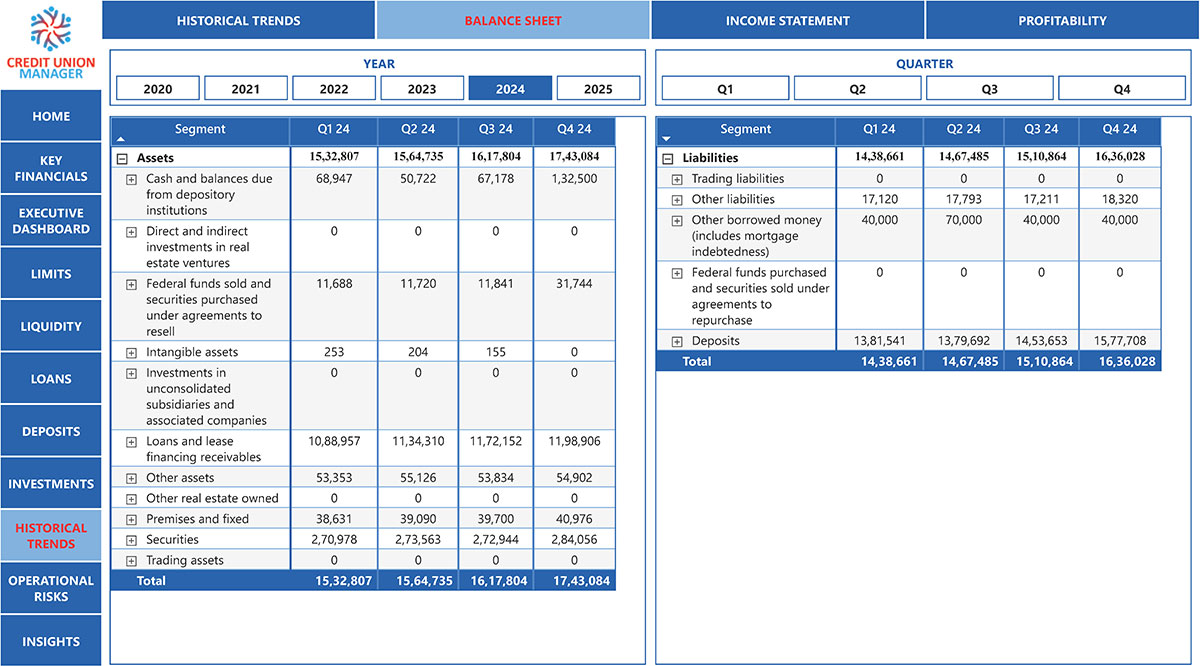

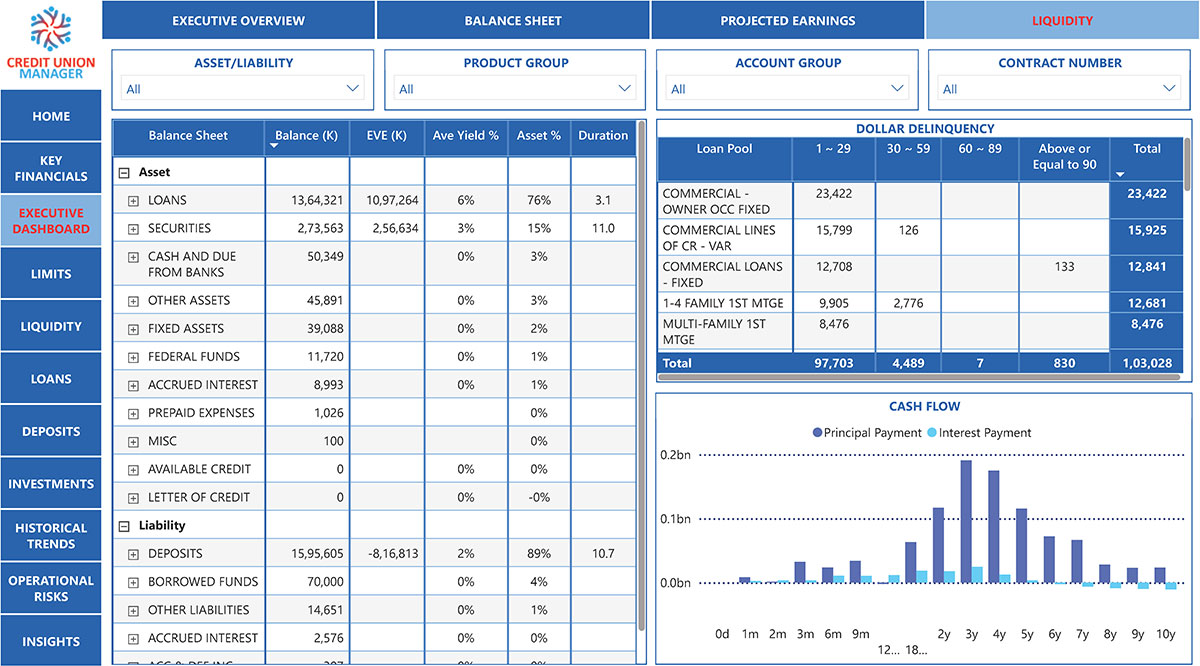

View and manage financial and credit performance and risk in one dashboard

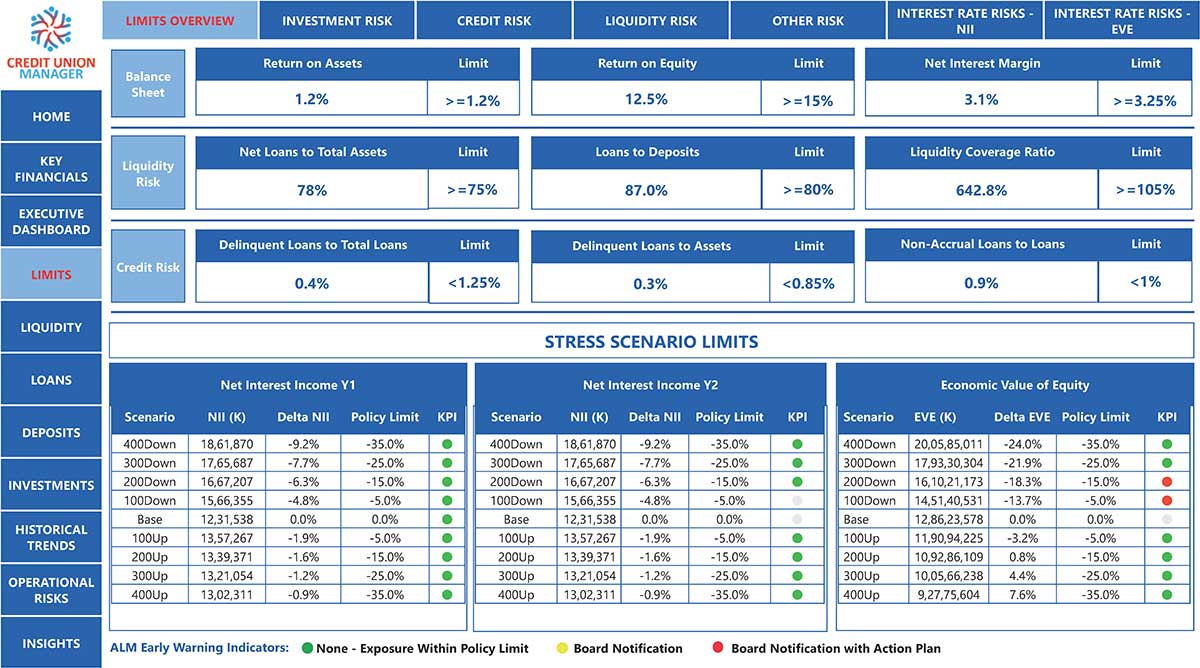

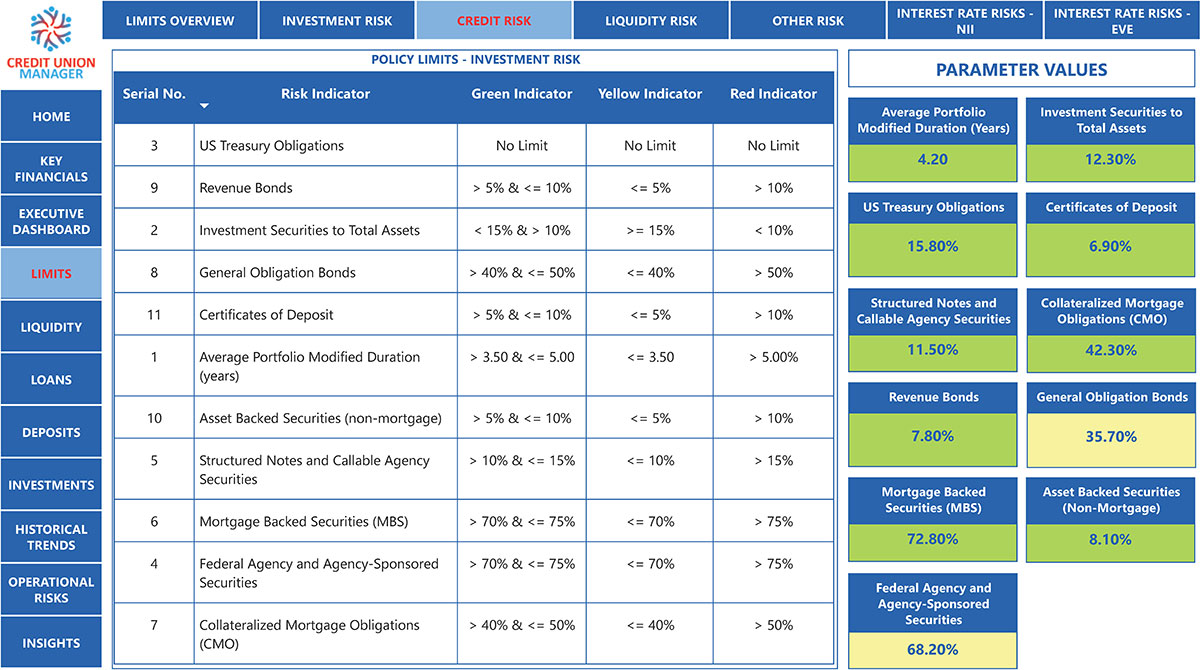

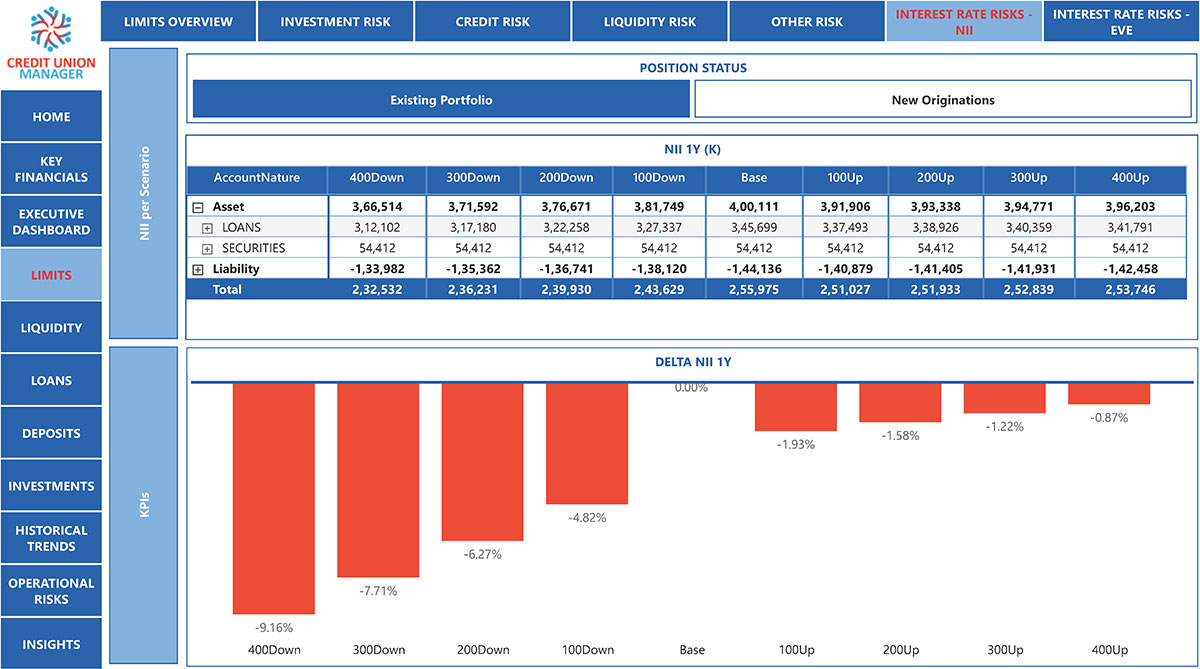

Continuously monitor ALM and credit limits

Restore, solidify, and maintain net worth ratio

Create ALCO packages in one hour

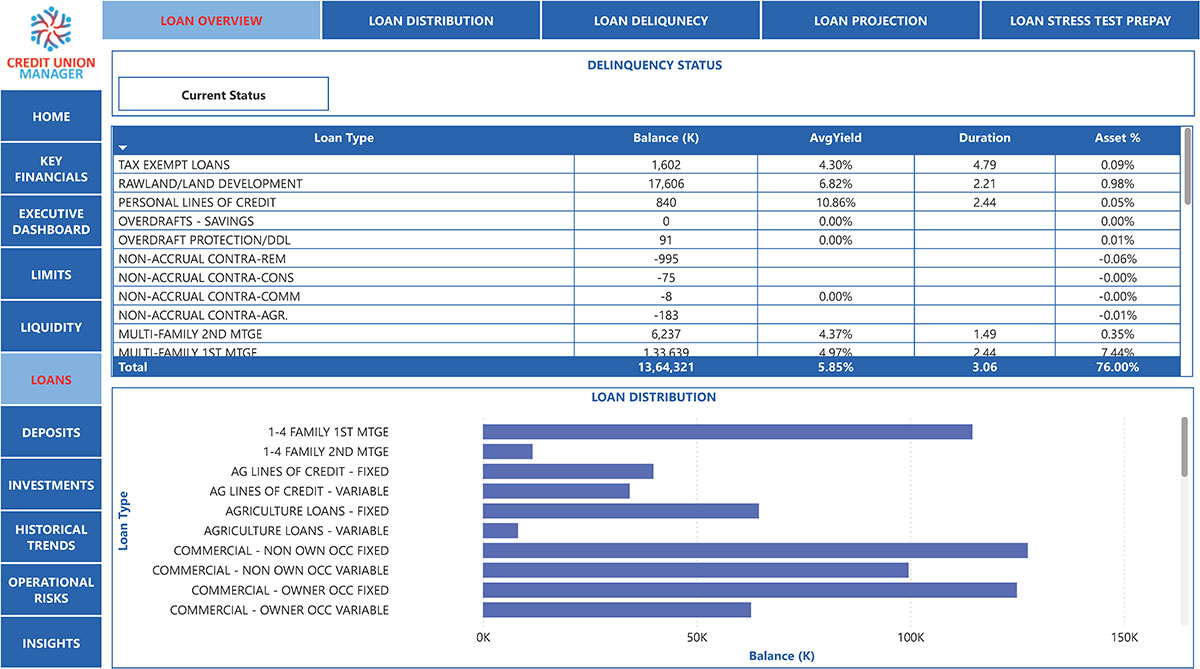

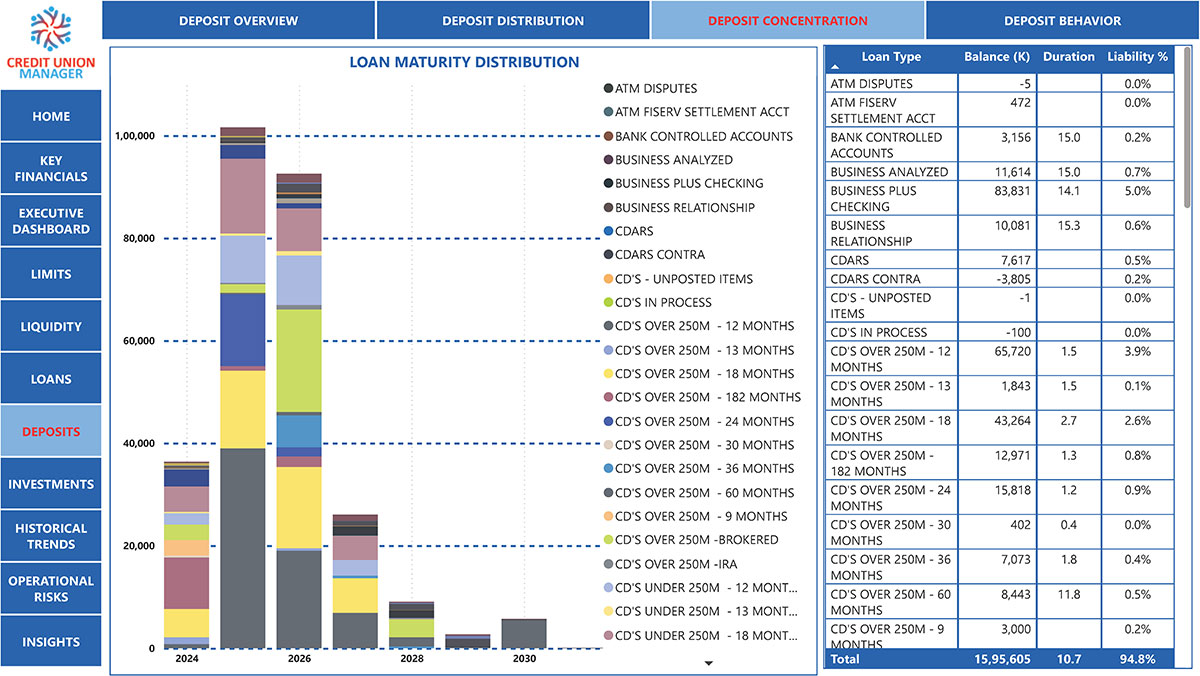

Generate accounting-level accuracy reports at individual loan and deposit levels

Enhance CFO and controller efficiency by 50%

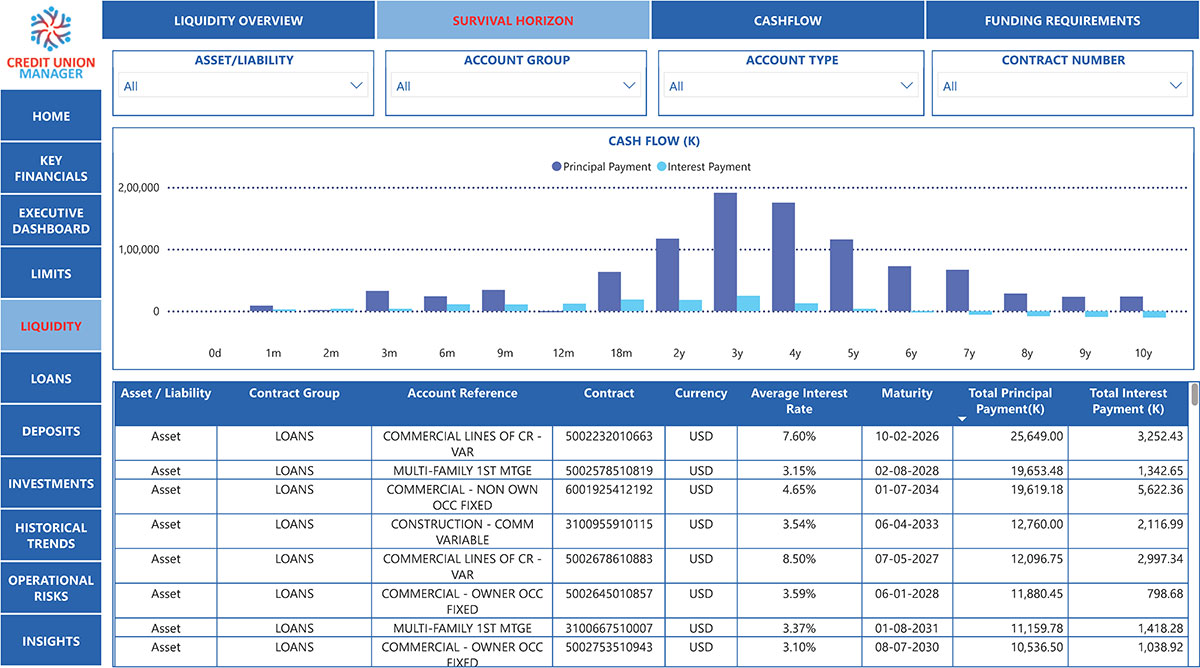

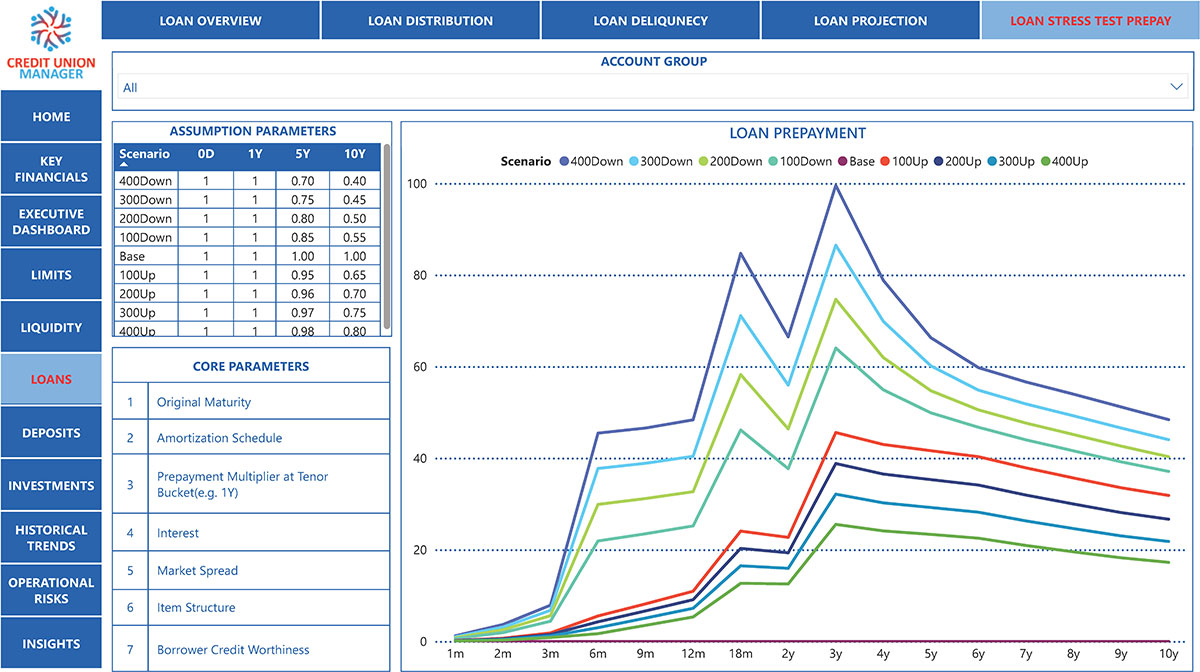

Create flexible interest rates, loan and deposit, and business scenarios

Make your core and GL data actionable

Automate calland regutatory filing

Create and continuously monitor stress scenarios

Drilldown to individual loan and deposit levels with three clicks

PLATFORMS

CUMAN is a unique industry-lending solution created from the ground up for credit unions. It is natively integrated with any core systems and requires minimal effort for implementation, and no ongoing IT support or maintenance.

Community Bank Manager (CBM) empowers banks with a comprehensive, intuitive, and scalable solution designed to enhance operational efficiency, risk management, and customer engagement.

CECL Express is a cloud-based solution design that makes CECL compliance a business opportunity for smaller banks. Intuitive screen design, market data provision, and ECL optimization are all core features of the platform.