CUMAN is a unique industry-lending solution created from the ground up for credit unions. CUMAN is natively integrated with any core systems and requires minimal effort for implementation, and no ongoing IT support or maintenance.

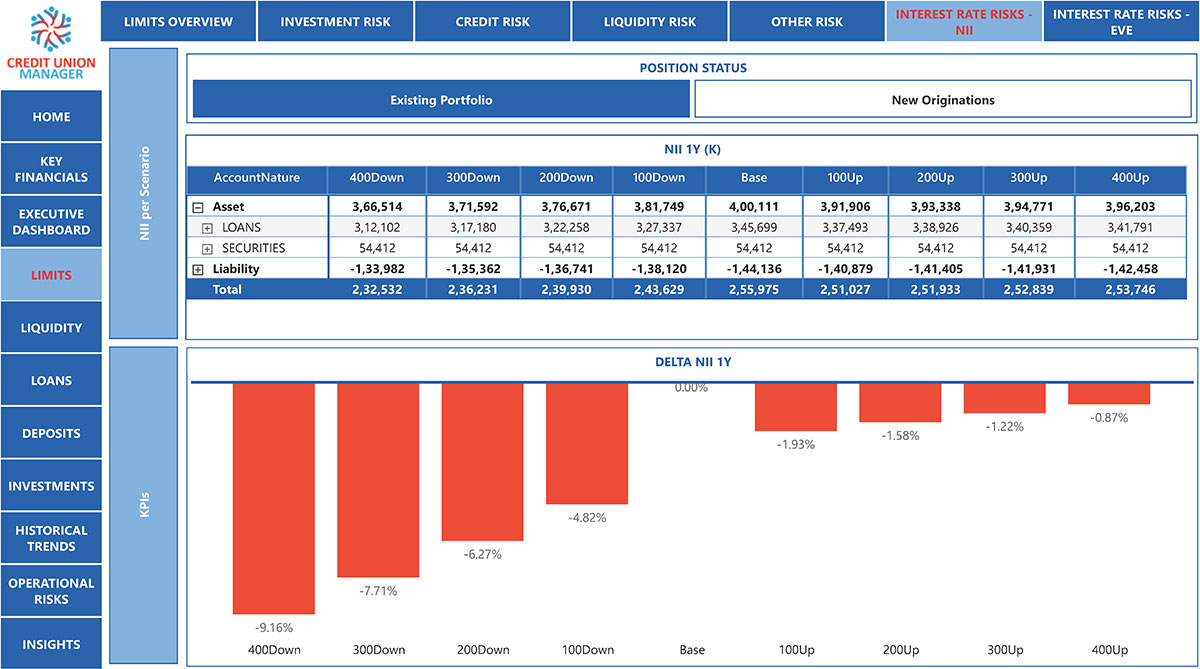

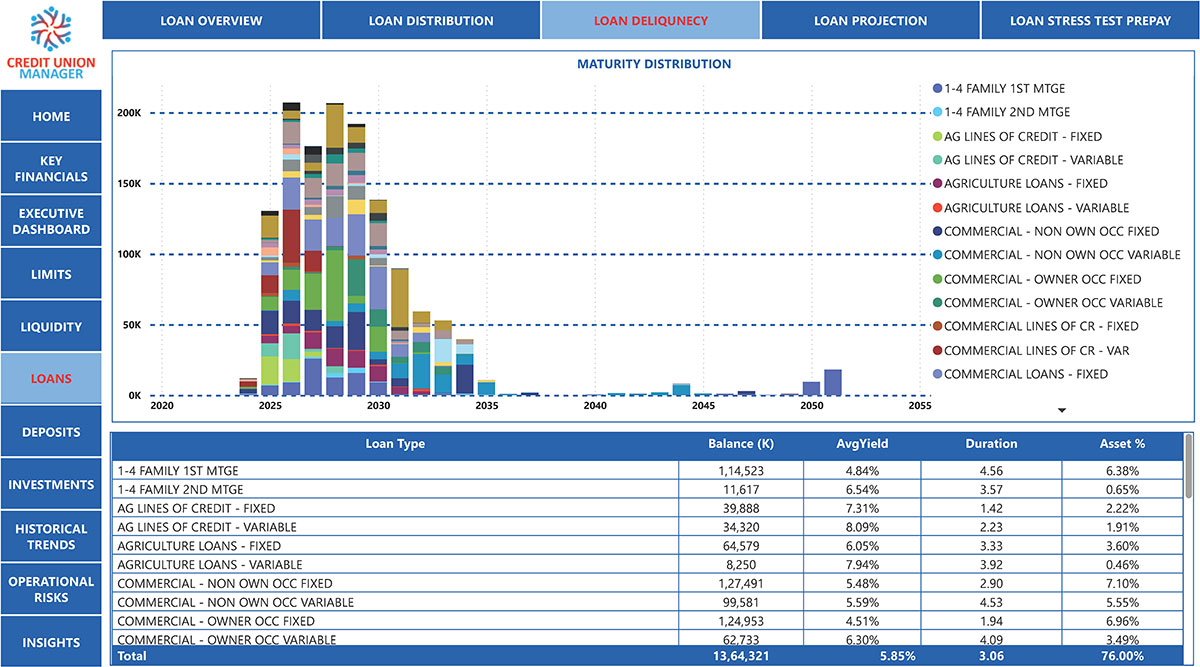

CUALM

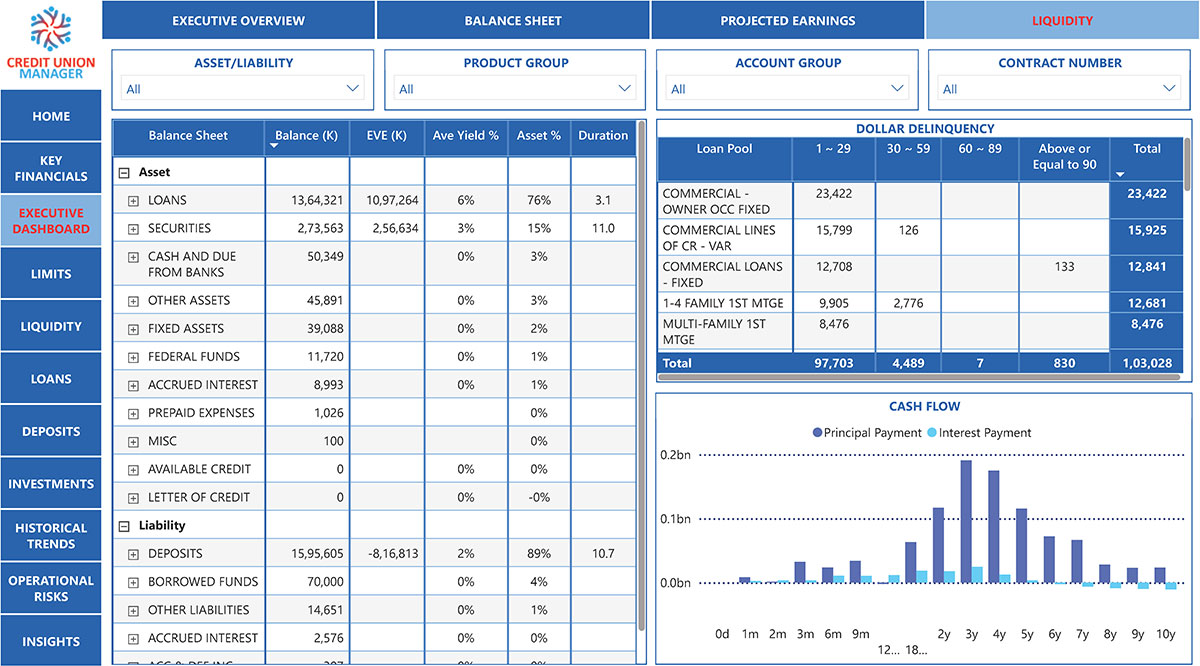

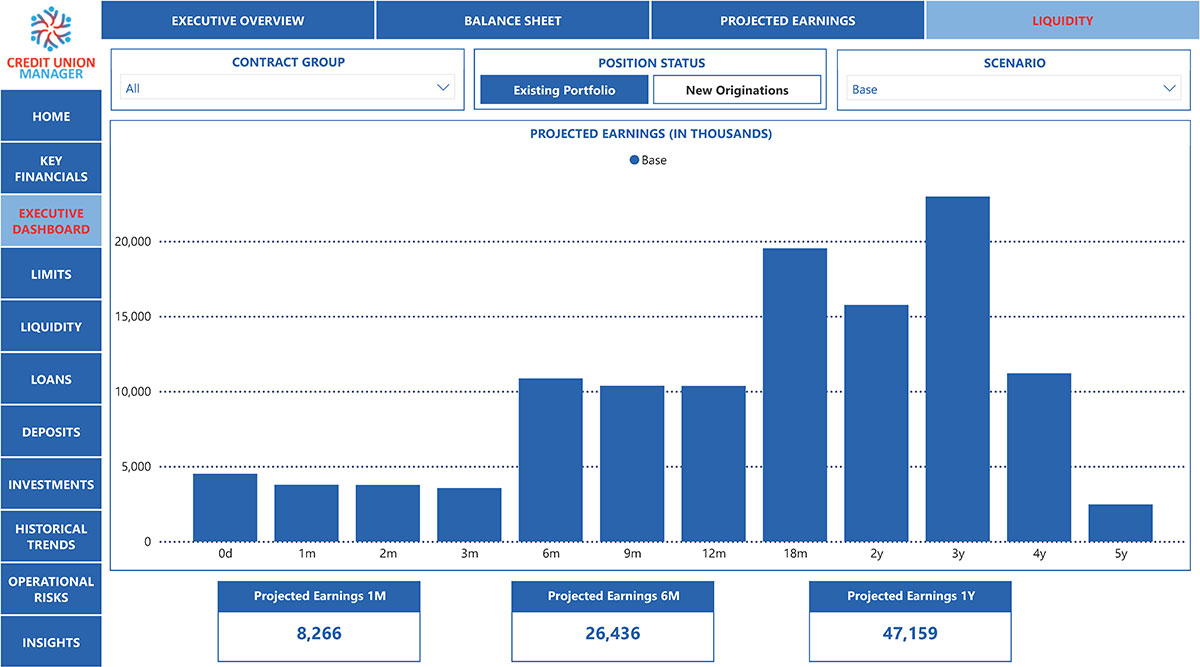

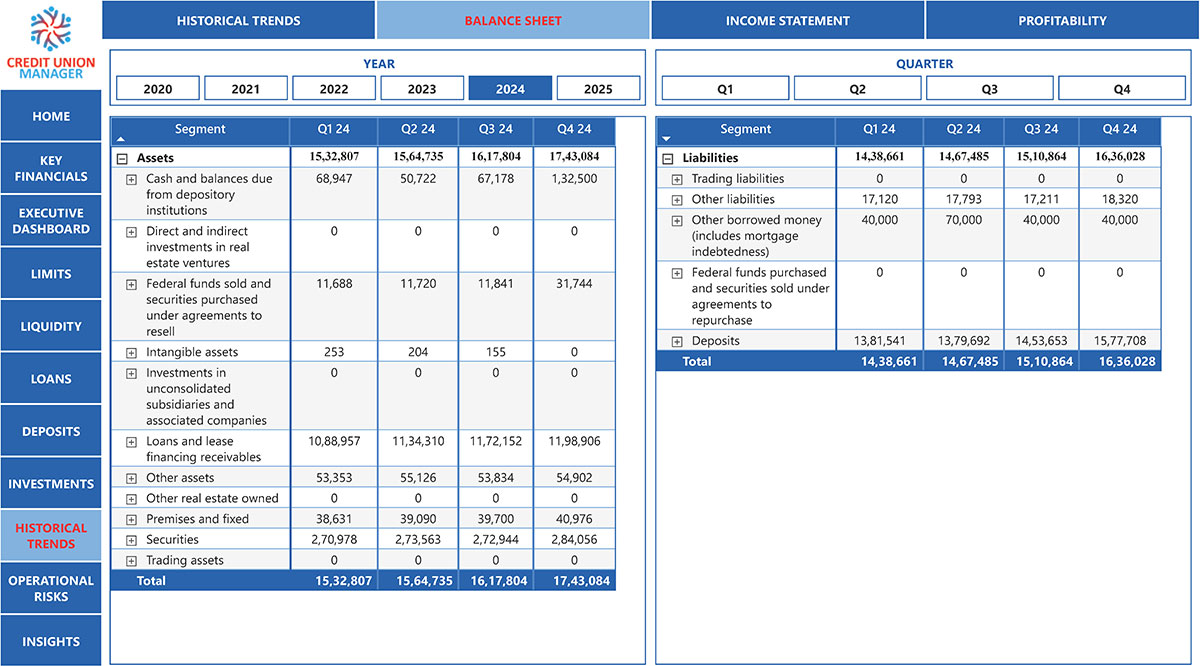

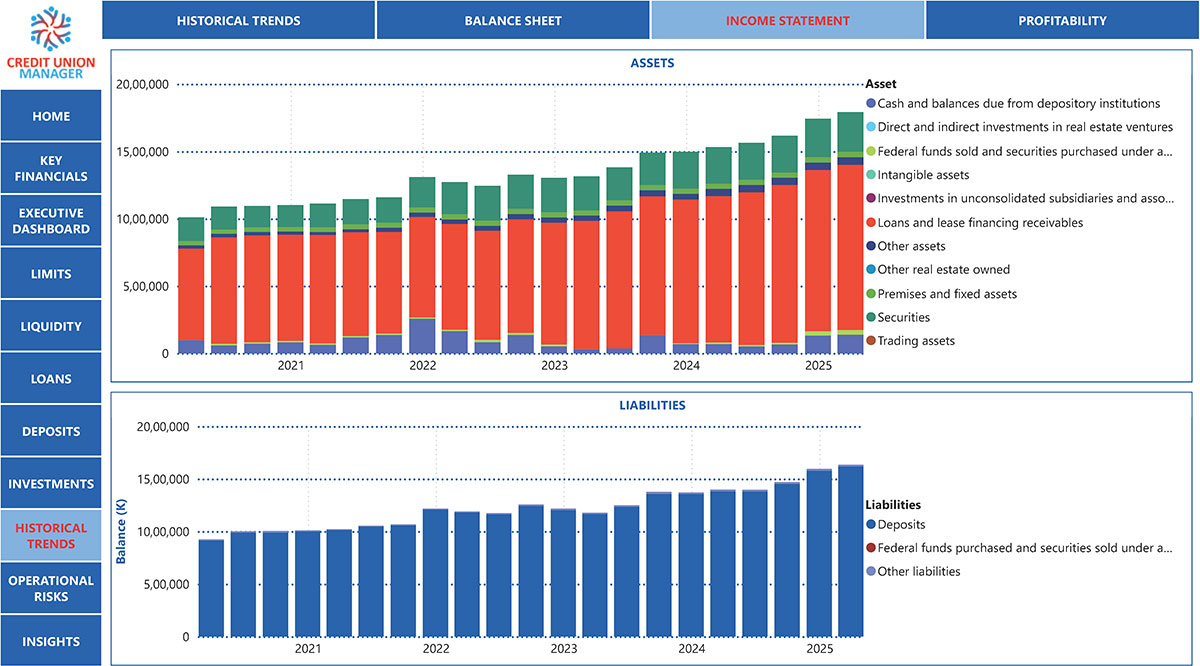

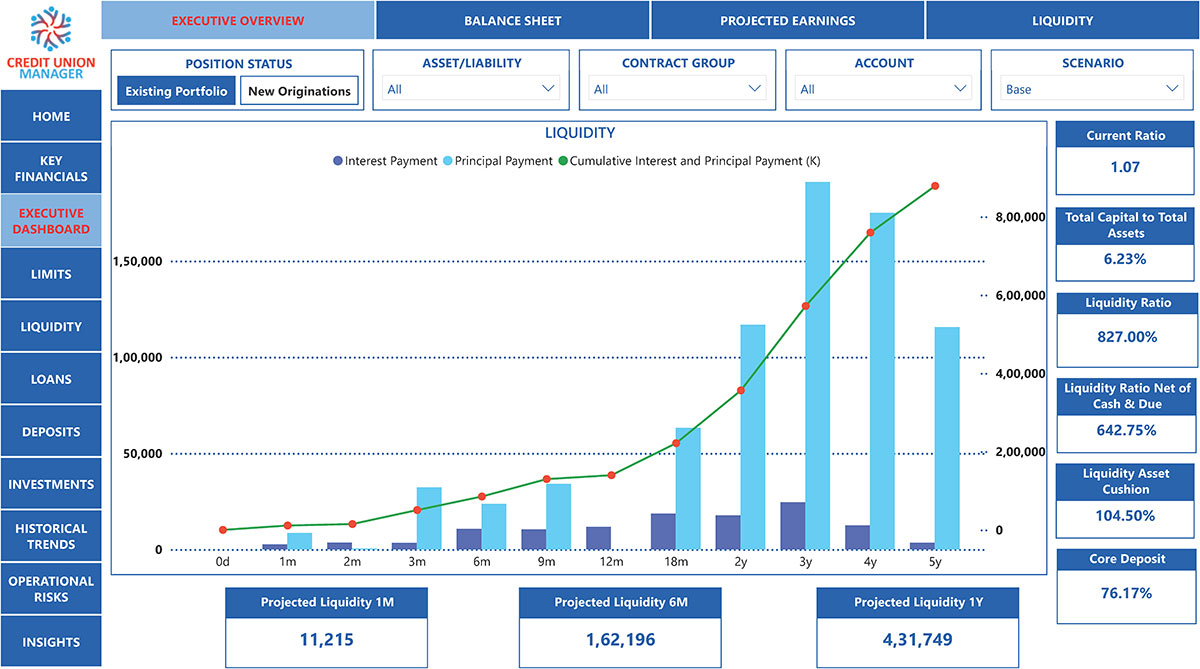

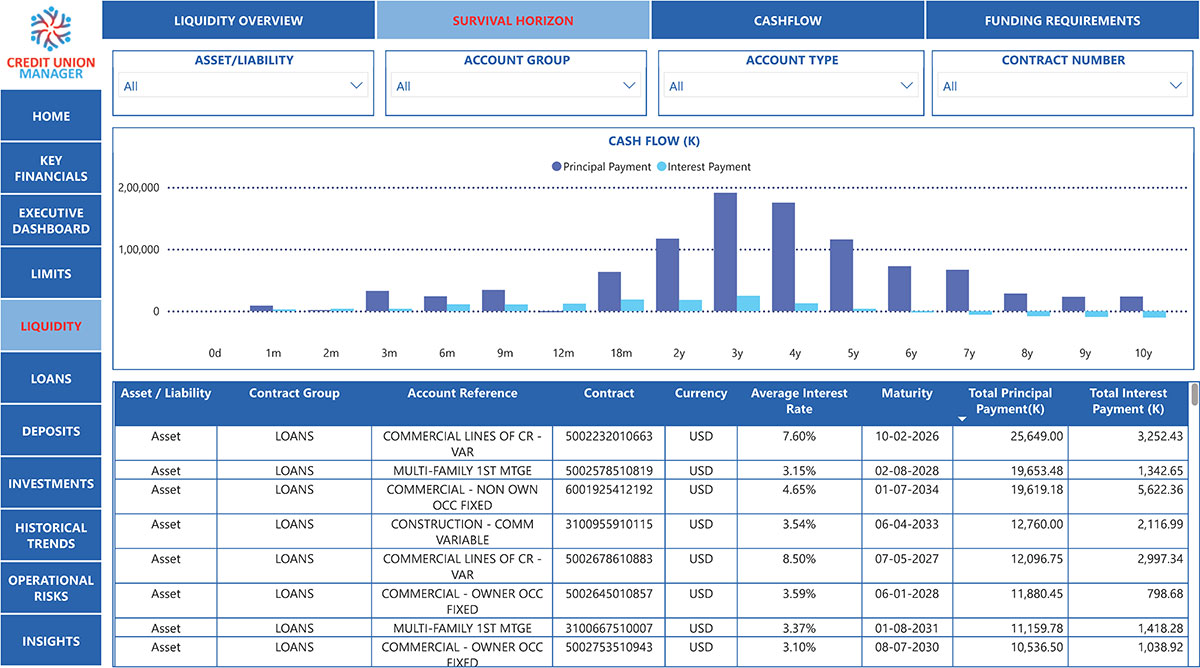

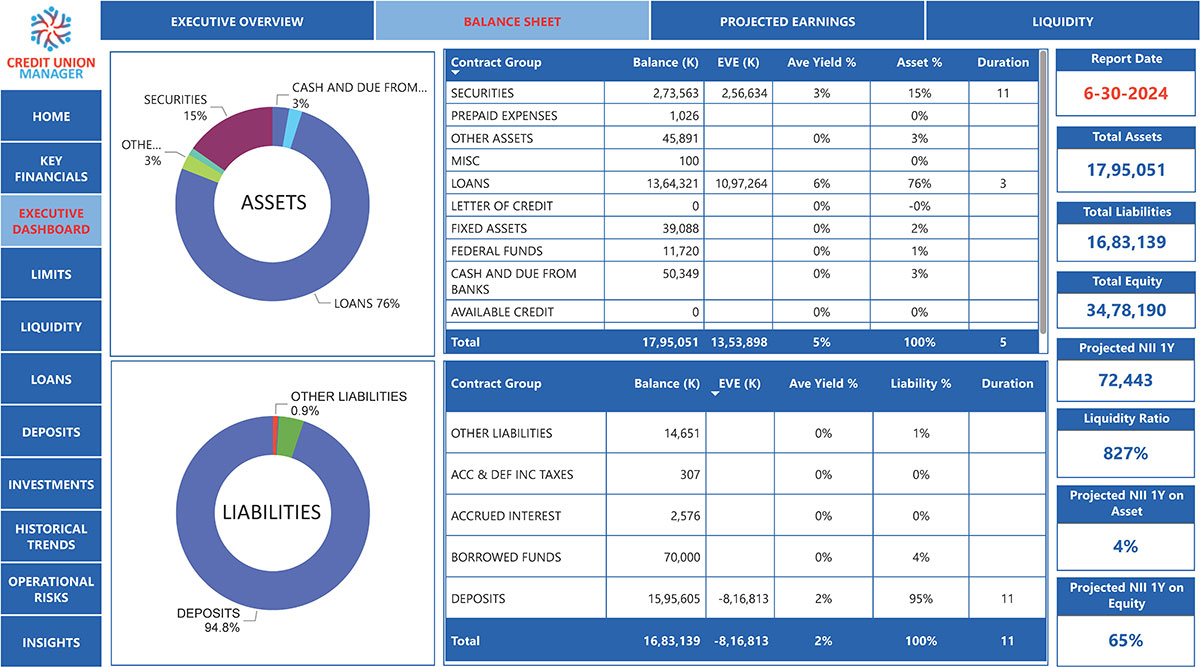

COMPREHENSIVE ALM PLATFORM WITH BOARD REPORTING

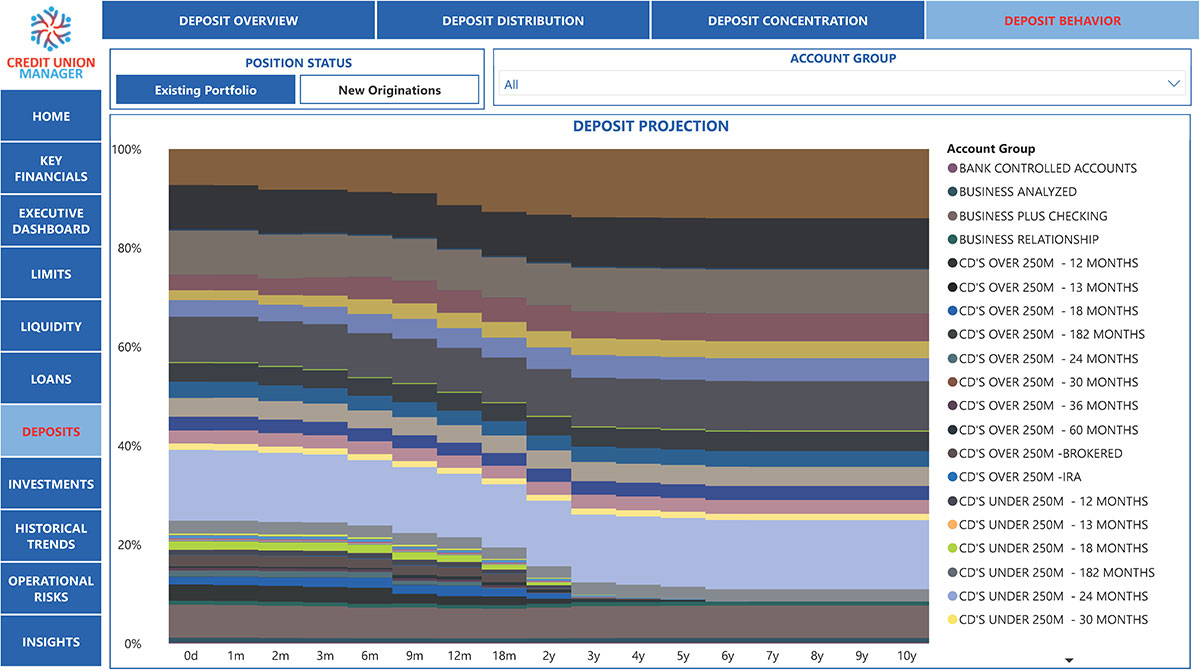

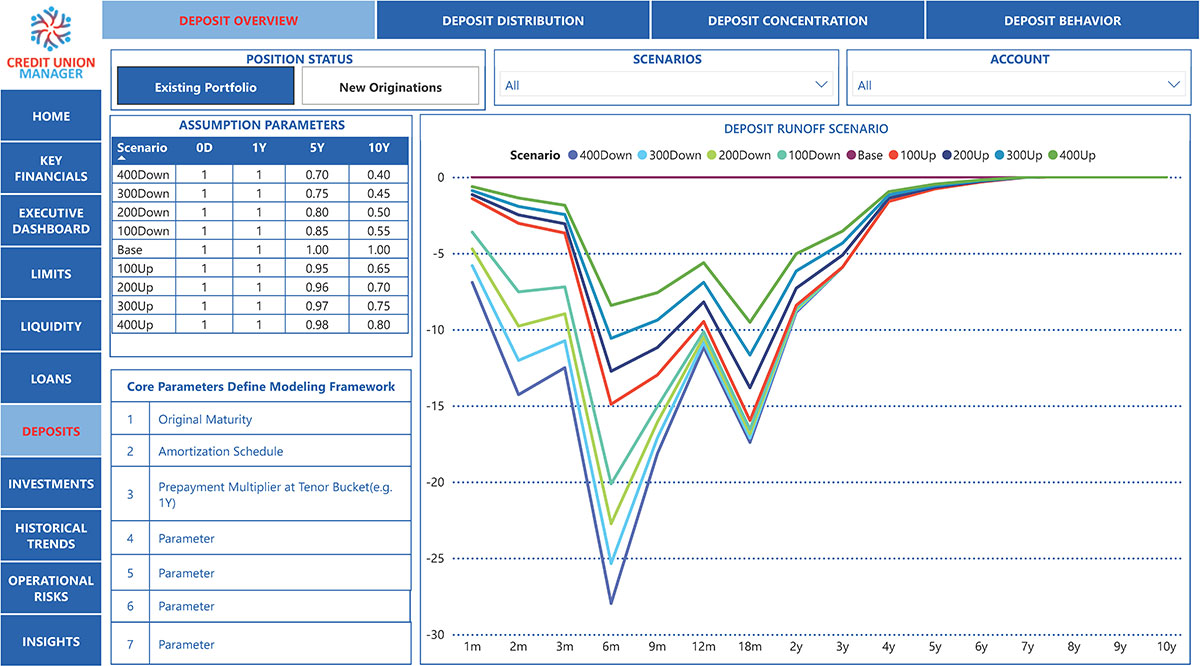

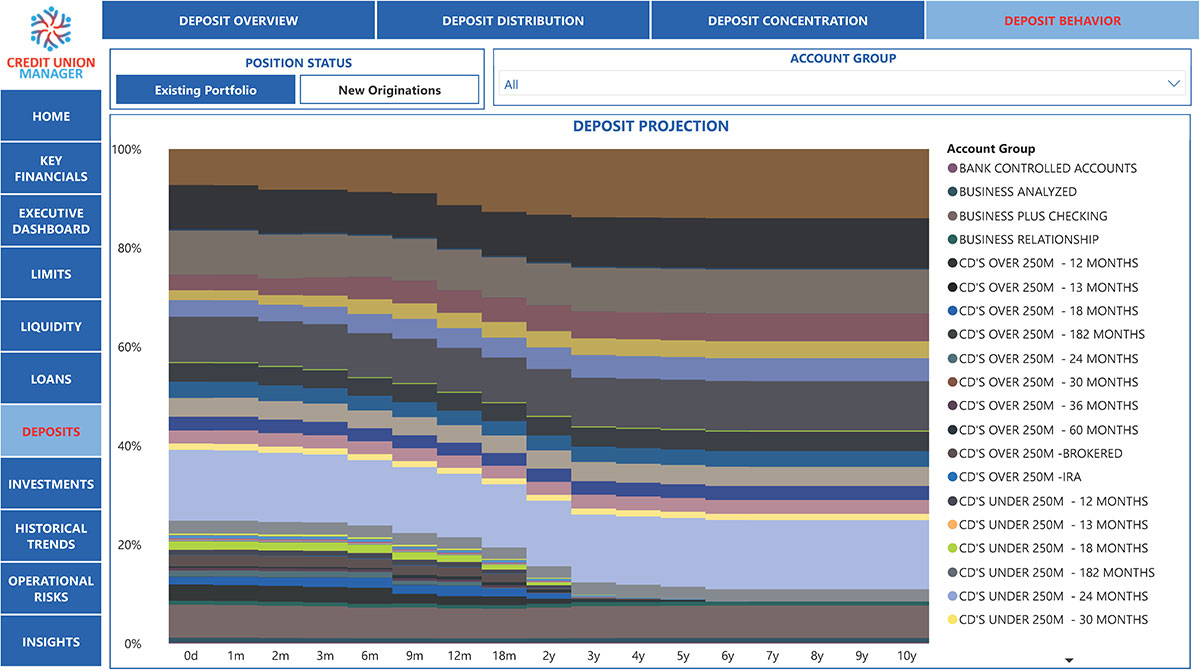

- Offers a comprehensive ALM framework with built-in board reporting tools

- Enables scenario-based modeling across economic and rate environments

- Assesses liquidity risk and interest rate sensitivity in real time

- Supports stress testing for both short- and long-term strategic plans

- Visualizes net interest margin dynamics and balance sheet evolution

- Incorporates customized forecasting assumptions and shock analysis

- Aligns risk exposures with organizational objectives and thresholds

- Streamlines reporting workflows for board, auditors, and regulators

- Enhances capital planning with forward-looking risk metrics

- Provides transparency across funding sources and maturity profiles

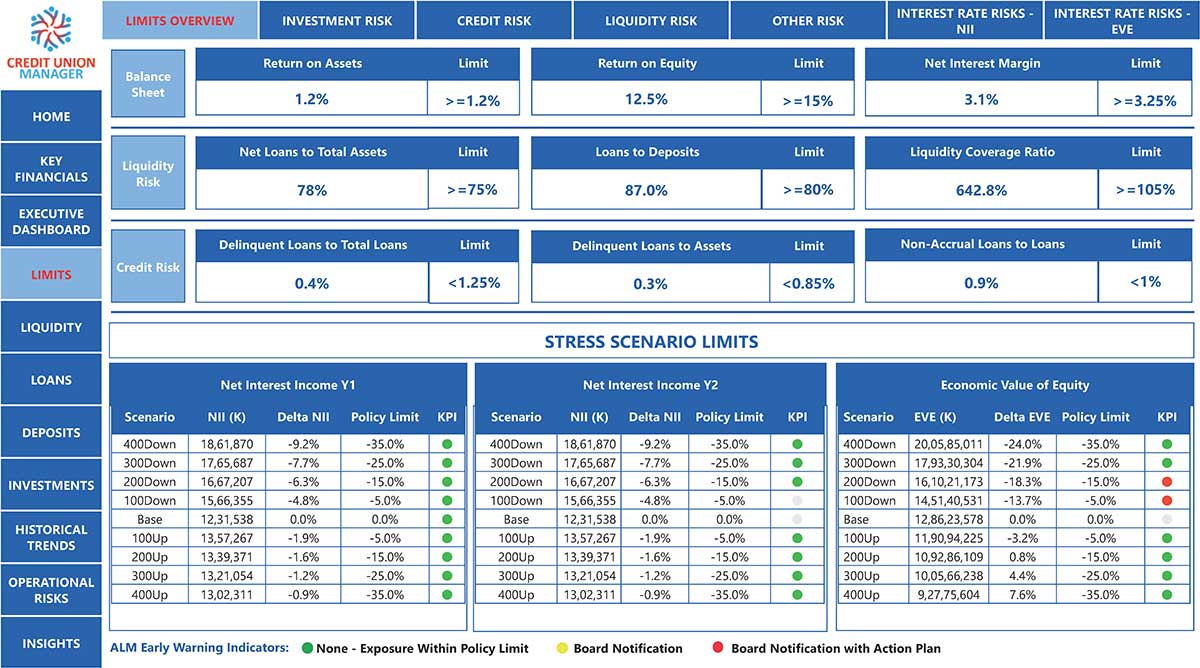

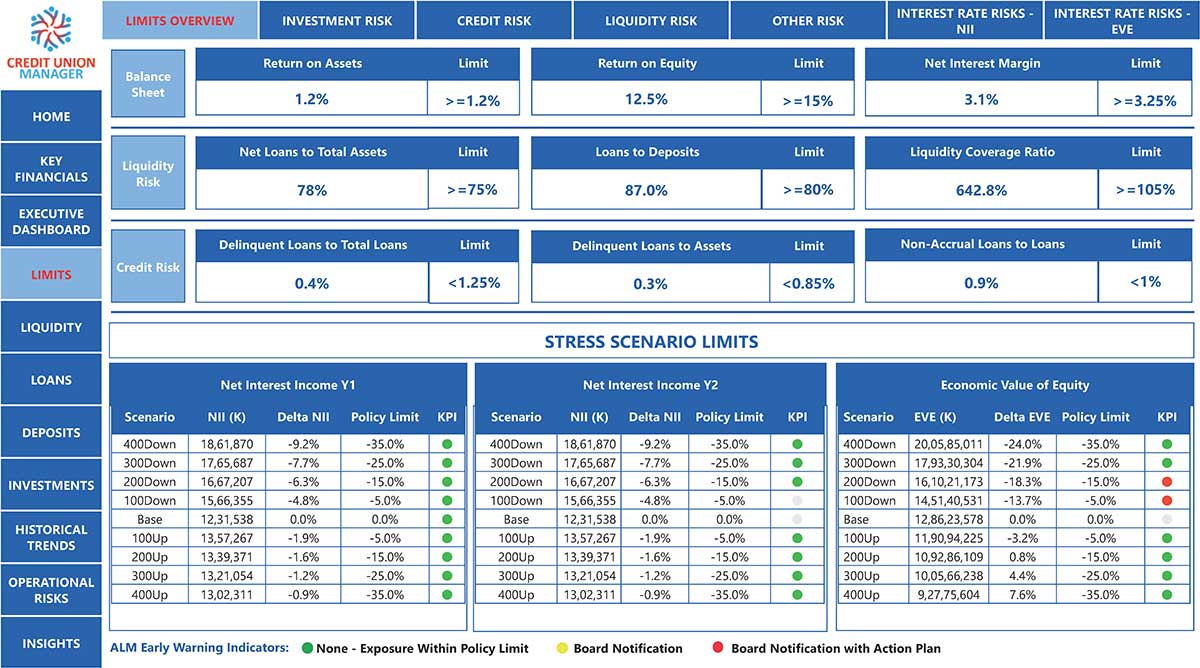

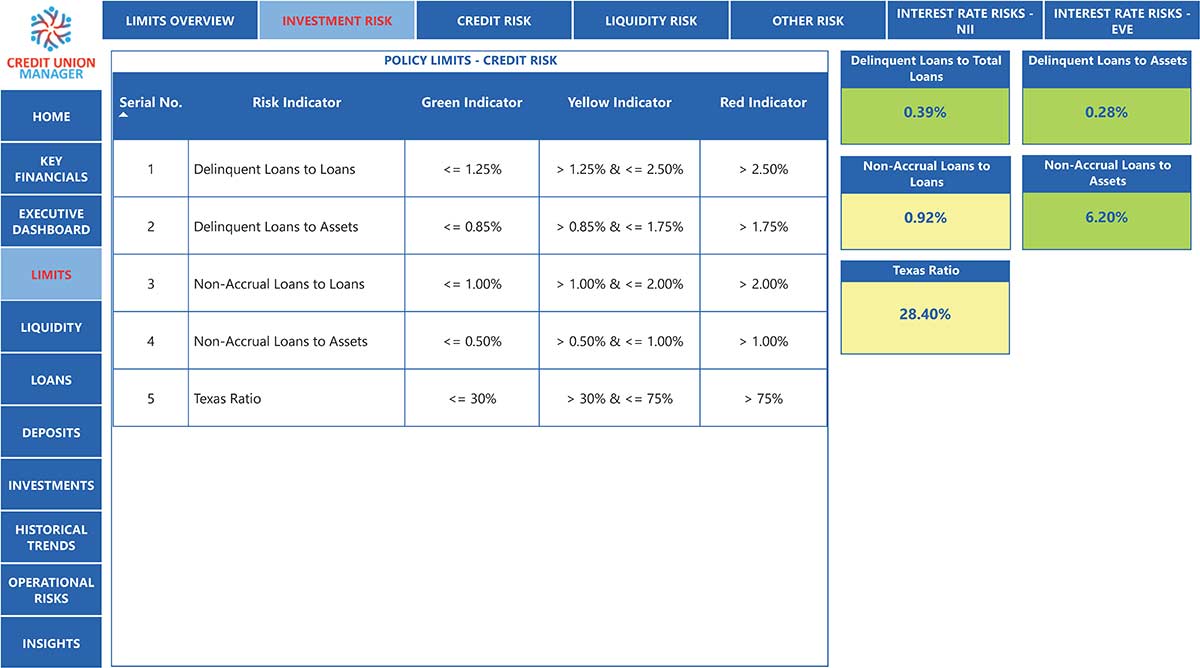

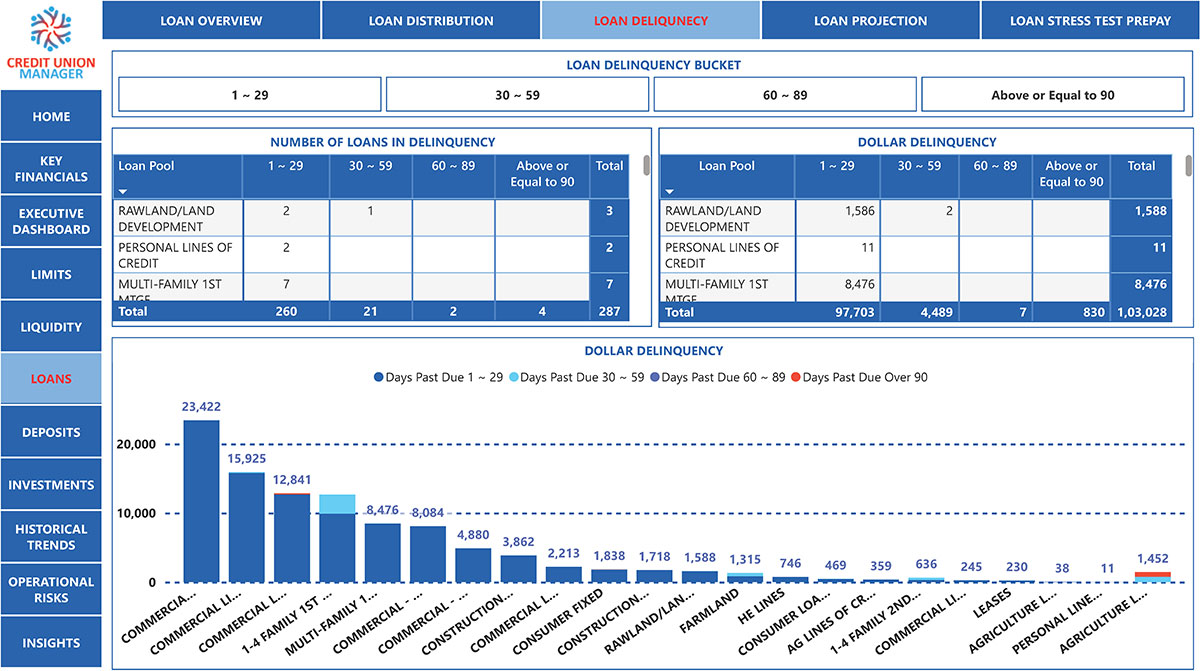

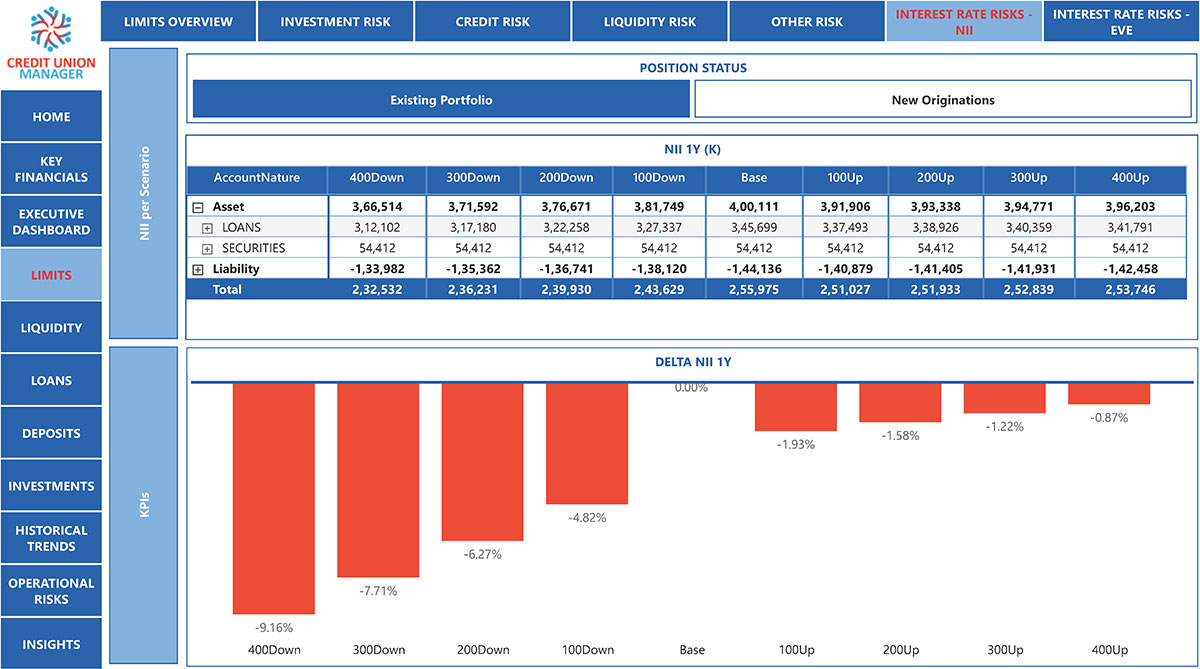

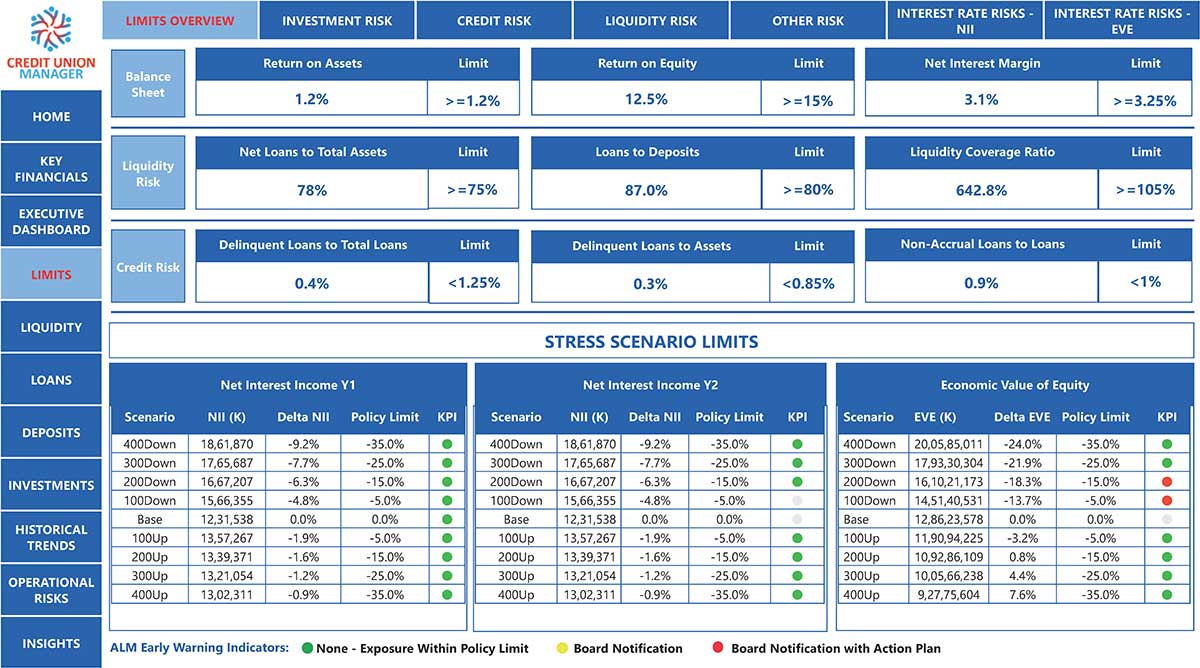

CULIMITS

LIMIT MANAGEMENT SYSTEM

- Manages lending thresholds across segments, tiers, and regions

- Automates alerts for limit breaches and exceptions

- Ensures compliance with internal policy and regulatory guidelines

- Tracks exposure levels by borrower category and product type

- Delivers audit-ready documentation for governance transparency

- Links directly with origination and approval platforms

- Enables strategic portfolio steering based on risk tolerance

- Facilitates reviews and updates to limit structures and controls

- Incorporates dashboards for oversight across management layers

- Helps balance risk appetite with growth objectives

CECL EXPRESS

RIGOROUS CECL RESERVE COMPUTATION ACROSS ALL METHODS

- Industry’s most powerful and comprehensive platform.

- Intuitive screen design, market data provision, and optimization of expected credit losses.

- All CECL loss methods covered including:

- 1. Weighted average remaining maturity

- 2. Roll Rate

- 3. Discounted cashflow

- 4. Probability of Default/Loss Given Default

- CORE TO BOARDTM reporting package

- Comprehensive model documentation for auditors and examiners

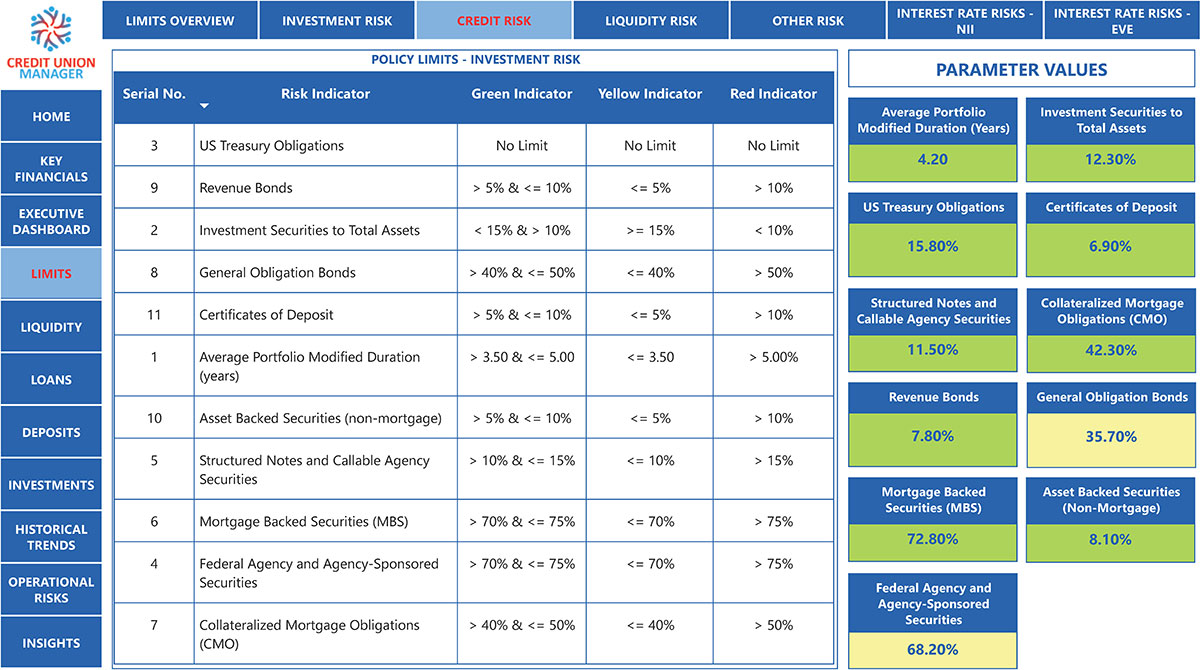

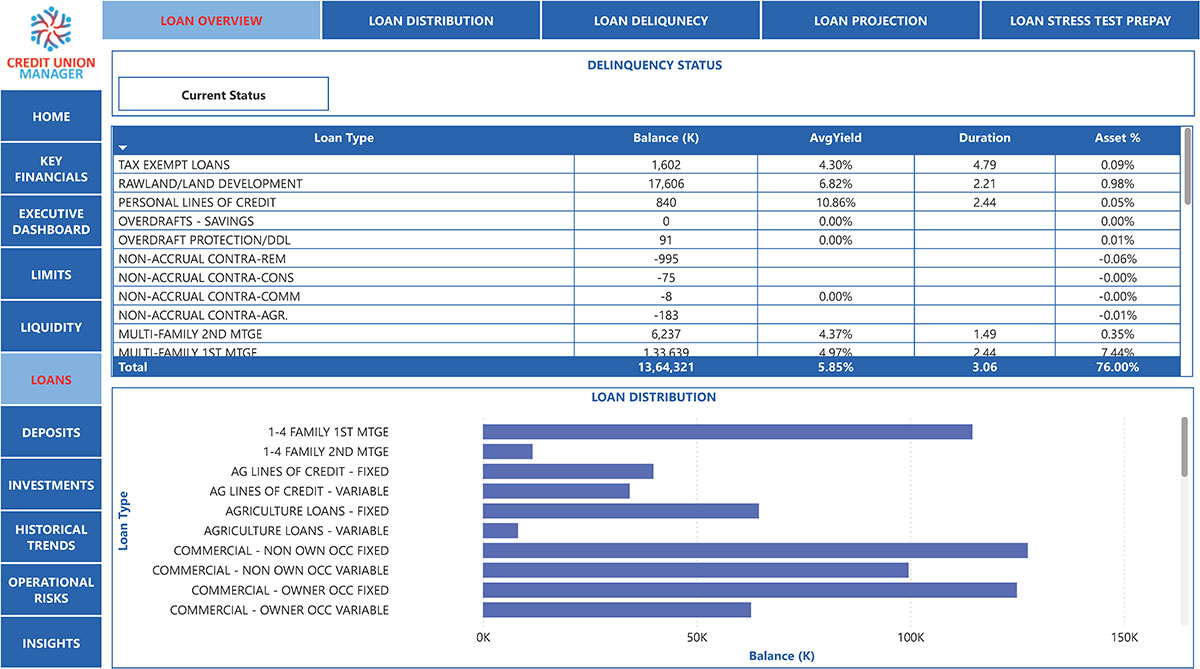

CUINVEST

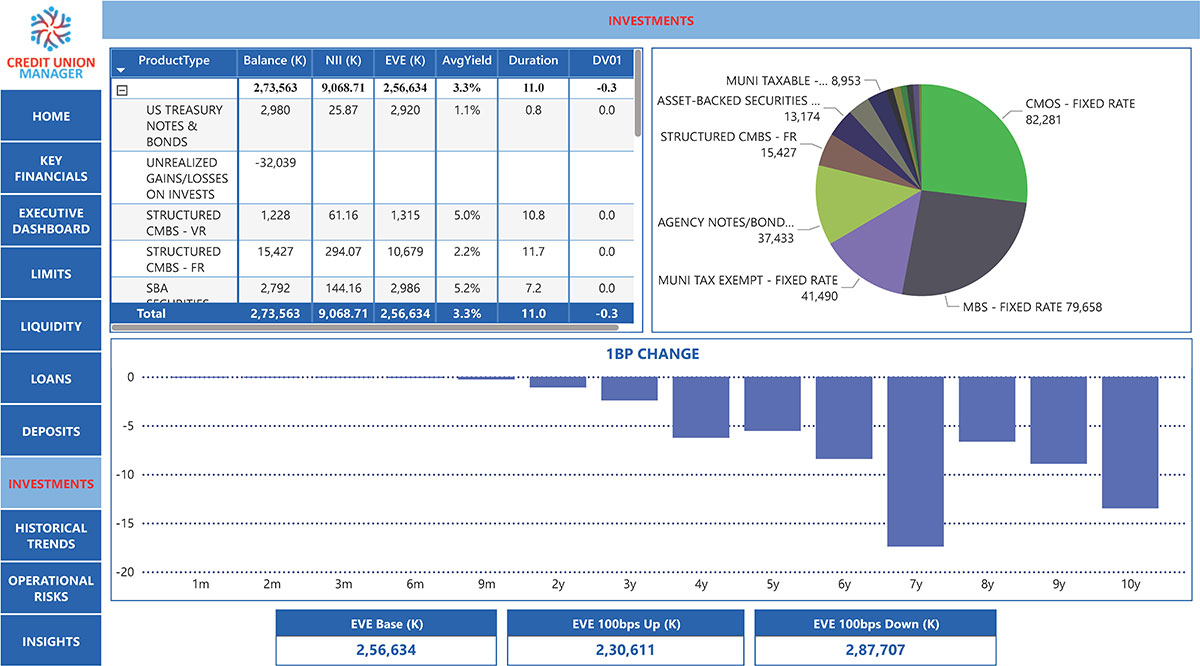

INVESTMENT ANALYSIS AND BOND ACCOUNTING

- Imports broker-provided securities data into interactive dashboards

- Provides real-time performance tracking and yield optimization tools

- Enables what-if analysis prior to purchase or liquidation decisions

- Combines market and portfolio metrics for effective oversight

- Reduces manual entry and spreadsheet errors across reporting cycles

- Aligns investment decisions with strategic objectives and risk limits

- Streamlines quarterly data ingestion and historical performance review

- Enhances reporting accuracy with consolidated views of asset classes

- Supports compliance validation against permissible investment rules

- Critical for navigating market volatility and capital allocation

CUPLAN

SECNARIO PLANNING AND BUDGETING PLATFORM

- Provides a flexible platform for economic, rate, and behavioral modeling

- Supports unlimited variables and scenario creation

- Tracks progress across daily, monthly, quarterly, and annual intervals

- Incorporates granular expense and revenue line-item forecasts

- Imports scenario outputs directly into board and executive packages

- Adapts to organizations of any size with tactical scalability

- Facilitates strategic planning and what-if simulation workflows

- Aligns budgets with operational goals and external market conditions

- Offers collaborative input capabilities for cross-functional teams

- Maintains a secure, centralized repository for plan versions

CUONE

ONE SOURCE DATA STORAGE AND RETRIEVAL

- Centralizes financial, loan, and performance data across systems

- Provides continuous syncing with core and loan platforms

- Stores up to 10 years of historical data for trend analysis

- Enhances team collaboration via version control and live updates

- Simplifies data sharing among management, boards, and auditors

- Eliminates fragmented spreadsheet workflows and manual updates

- Improves data integrity and reduces reporting errors

- Secures access with role-based permissions and audit tracking

- Streamlines analytics by unifying data under one platform

- Delivers real-time visibility into organizational performance

CUREG

AUTOMATED CALL REPORTS AND NCUA EXAMINER PACKAGES

- Automates creation of examiner-ready information packages

- Extracts data directly from internal systems into compliance templates

- Incorporates feedback and follow-ups from previous exams

- Aligns with regulatory guidelines and best practice standards

- Supports one-click generation of reporting documents

- Reduces time spent preparing examination materials

- Enhances transparency for auditors and supervisory teams

- Allows integration of management narratives and qualitative insights

- Tracks past findings to improve future exam readiness

- Enables cross-referencing with regulatory comment databases

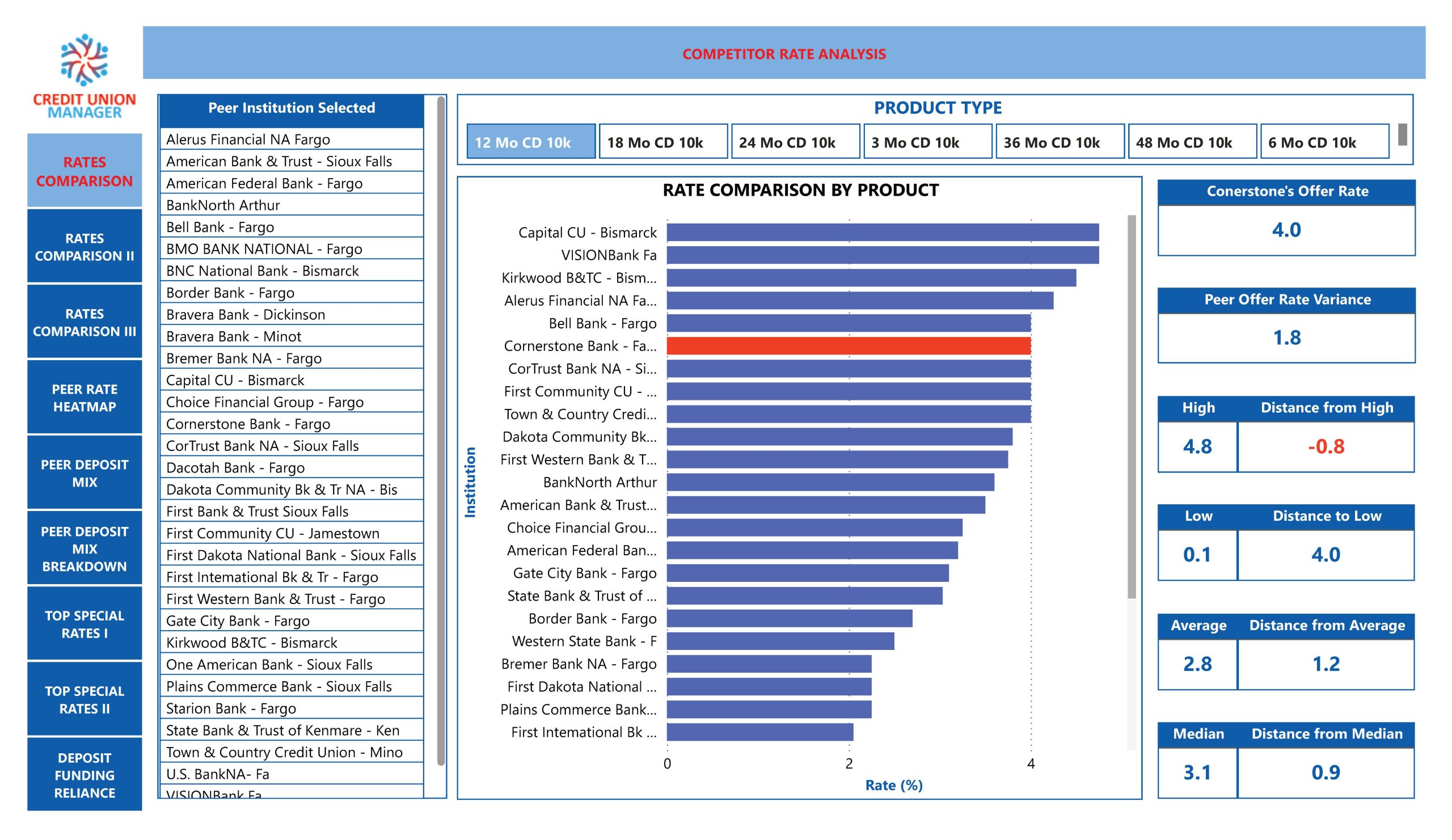

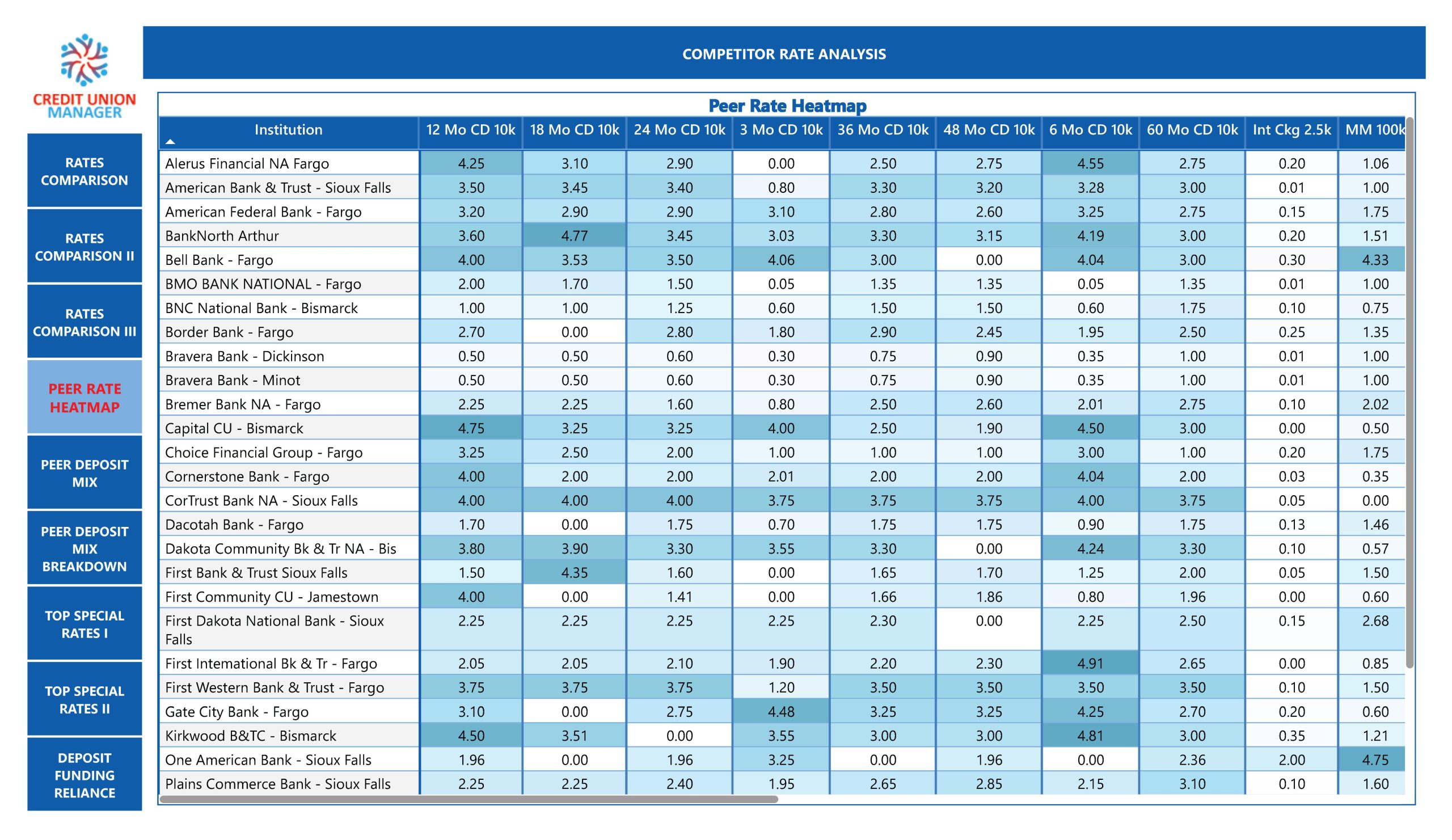

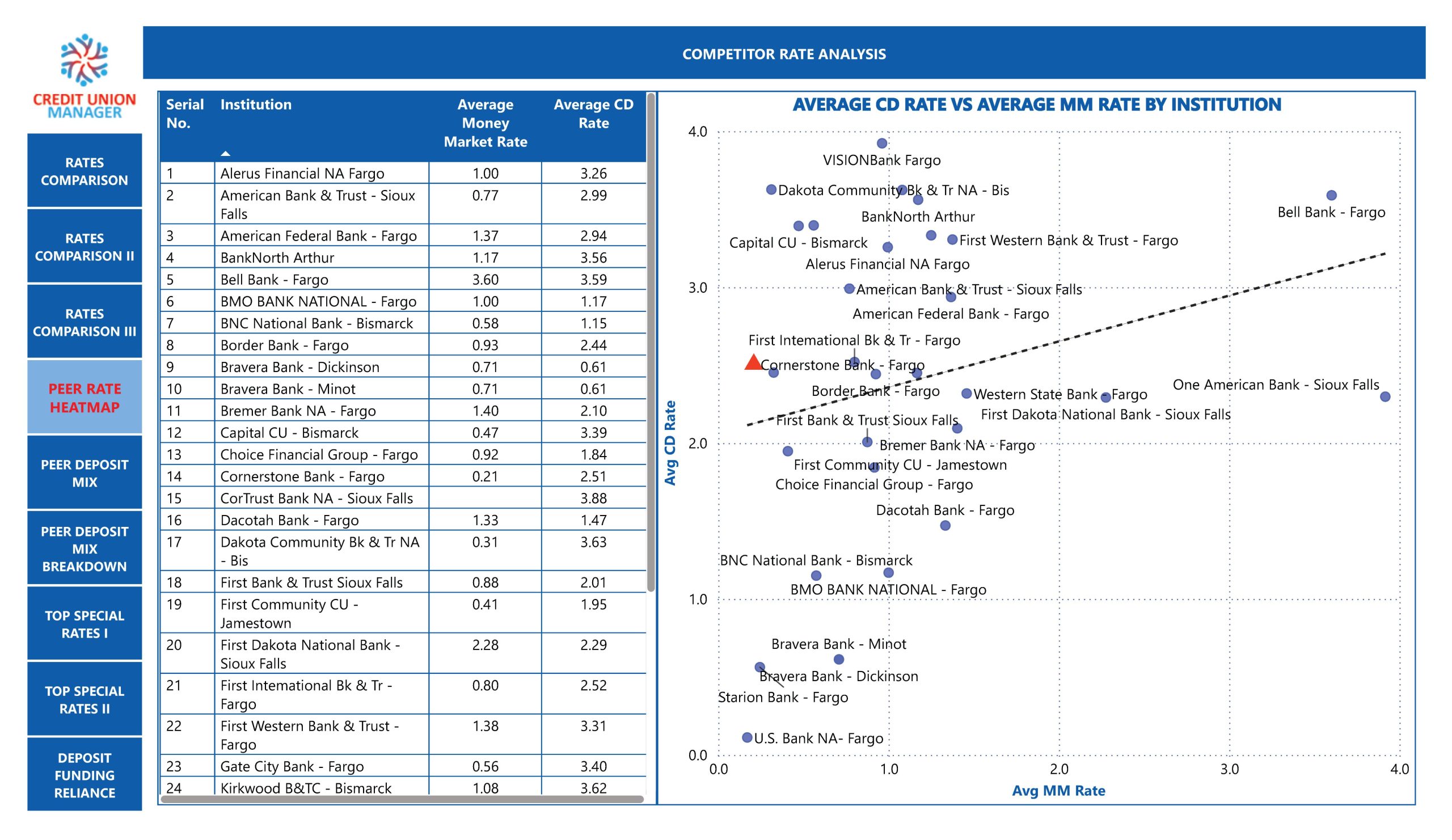

CUPEER

PEER RATES AND PERFORMANCE ANALYSIS

- Integrates public industry data for competitive benchmarking

- Maps peer metrics into internal planning and reporting workflows

- Delivers insights on rates, returns, and operational performance

- Provides customizable dashboards for trend tracking and analysis

- Enables side-by-side comparisons with similar institutions

- Supports strategic planning with peer-aligned performance goals

- Incorporates peer benchmarks into board and examiner packages

- Highlights strengths and gaps relative to industry norms

- Updates regularly with market shifts and new peer data

- Offers visual summaries for executive interpretation

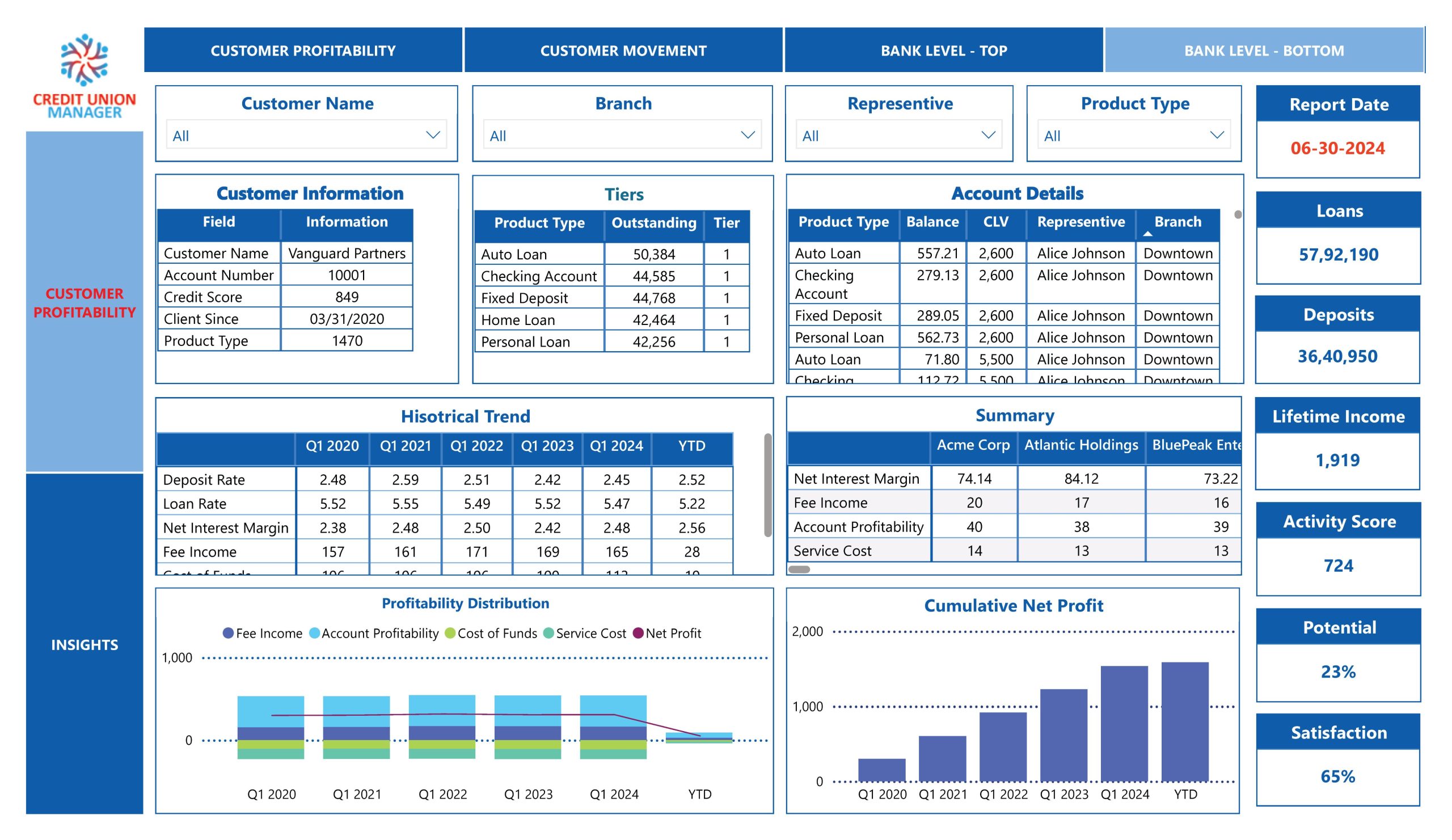

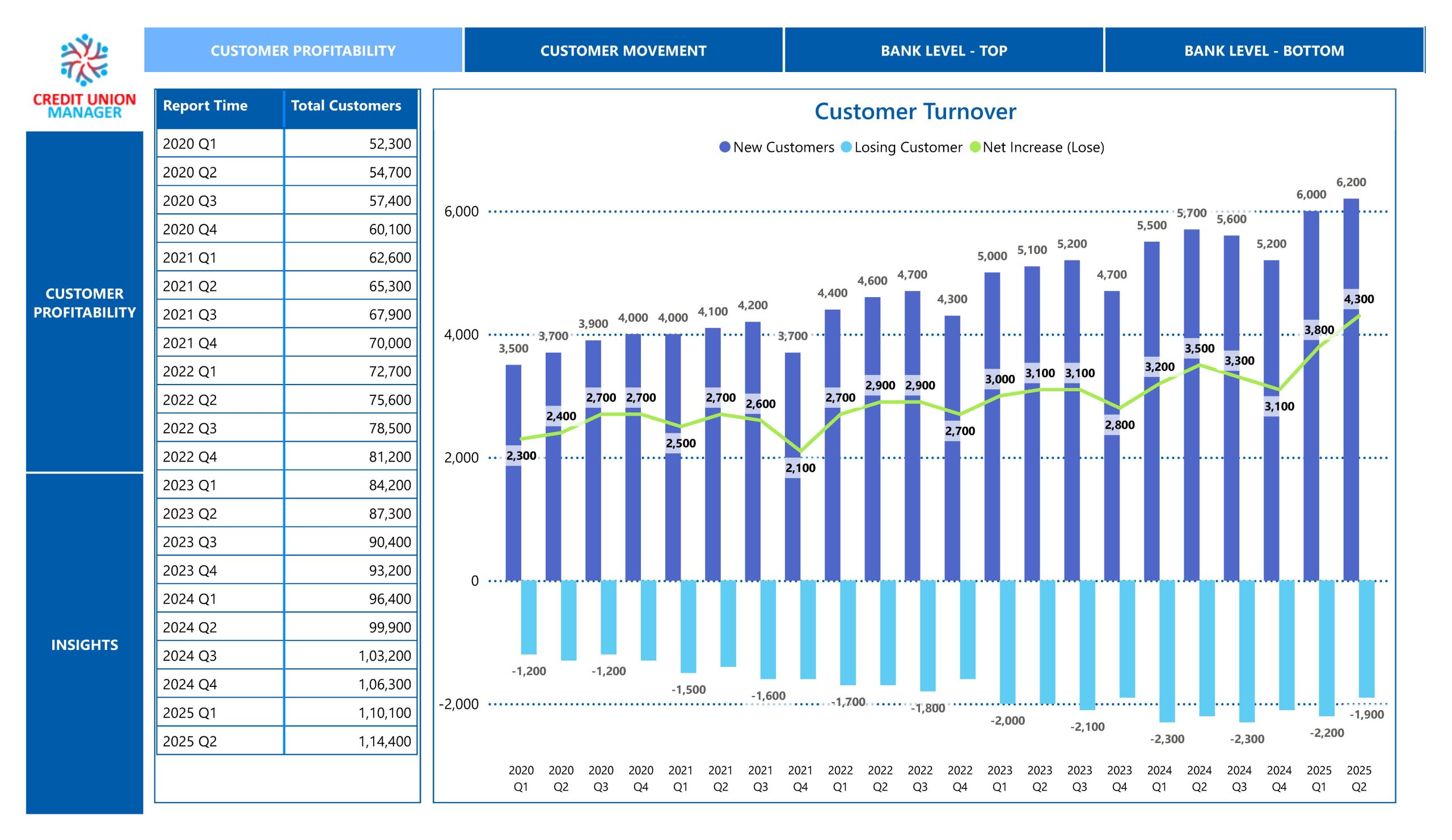

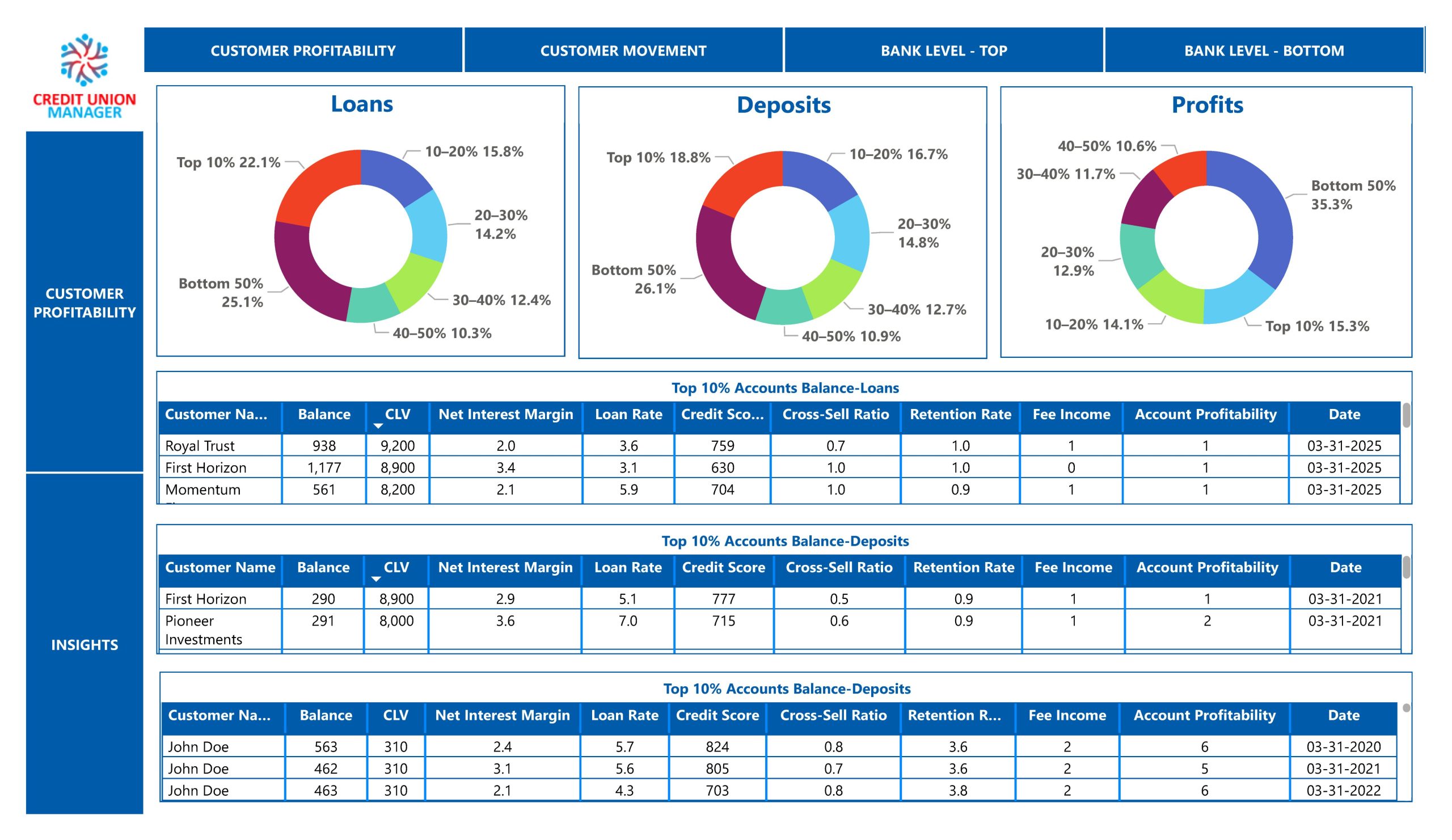

CUCLIENT

CLIENT PROFITABILITY

- Segments client data by relationship value and revenue contribution

- Calculates profitability metrics using customizable cost drivers

- Visualizes client retention, growth, and revenue trends

- Assists in strategic pricing and service tier decisions

- Highlights high-value relationships for targeted outreach

- Maps profitability by product, channel, or segment

- Links financial outcomes with operational and service inputs

- Tracks changes in client behaviour over time

- Enables scenario modelling to project future relationship value

- Supports alignment with overall business strategy

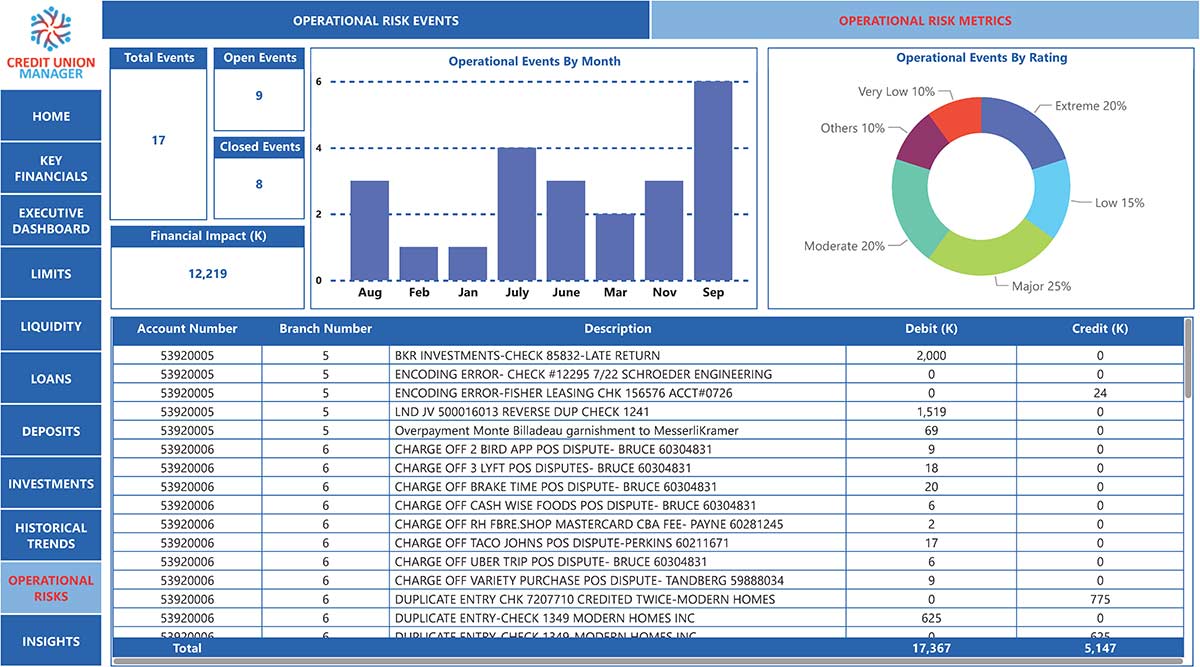

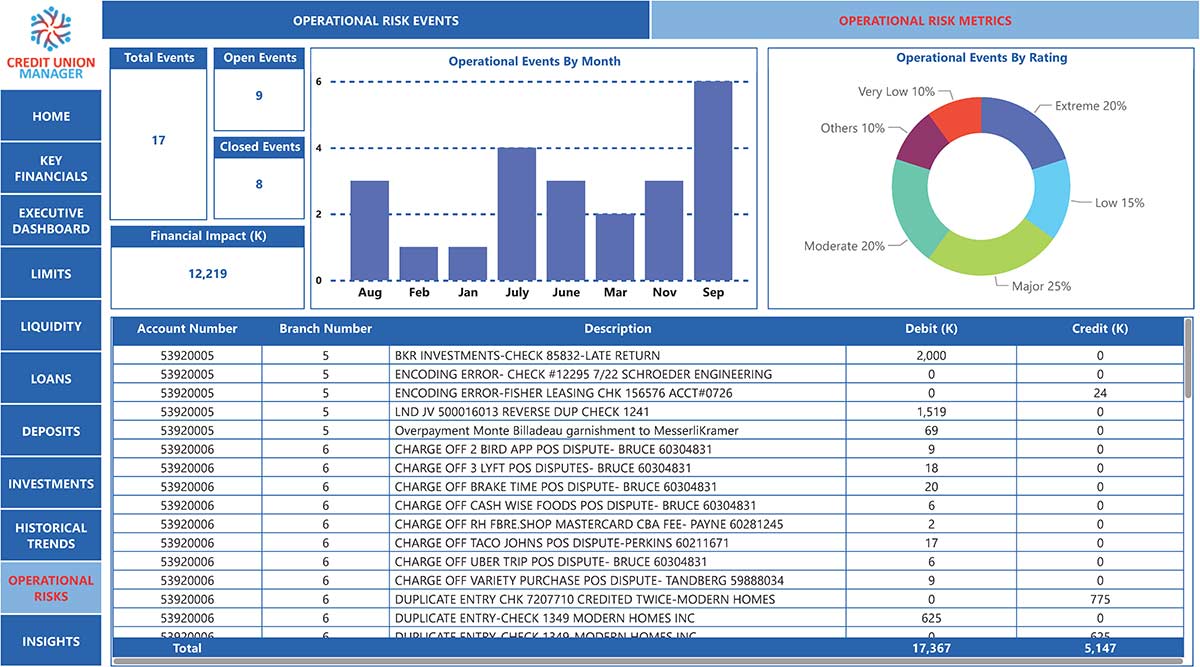

CUOPS

OPERATIONAL RISK MANAGEMENT

- Identifies and tracks process, systems, and human-related risks

- Provides a centralized risk register with categorization workflows

- Flags risk exposures by severity, likelihood, and control status

- Supports scenario modeling to assess operational resilience

- Links risk events to mitigation actions and responsible teams

- Enables historical tracking for trend analysis and audit readiness

- Integrates key metrics into performance dashboards

- Facilitates real-time updates and incident logging

- Helps establish thresholds for operational stability

- Aligns with broader enterprise risk and compliance frameworks

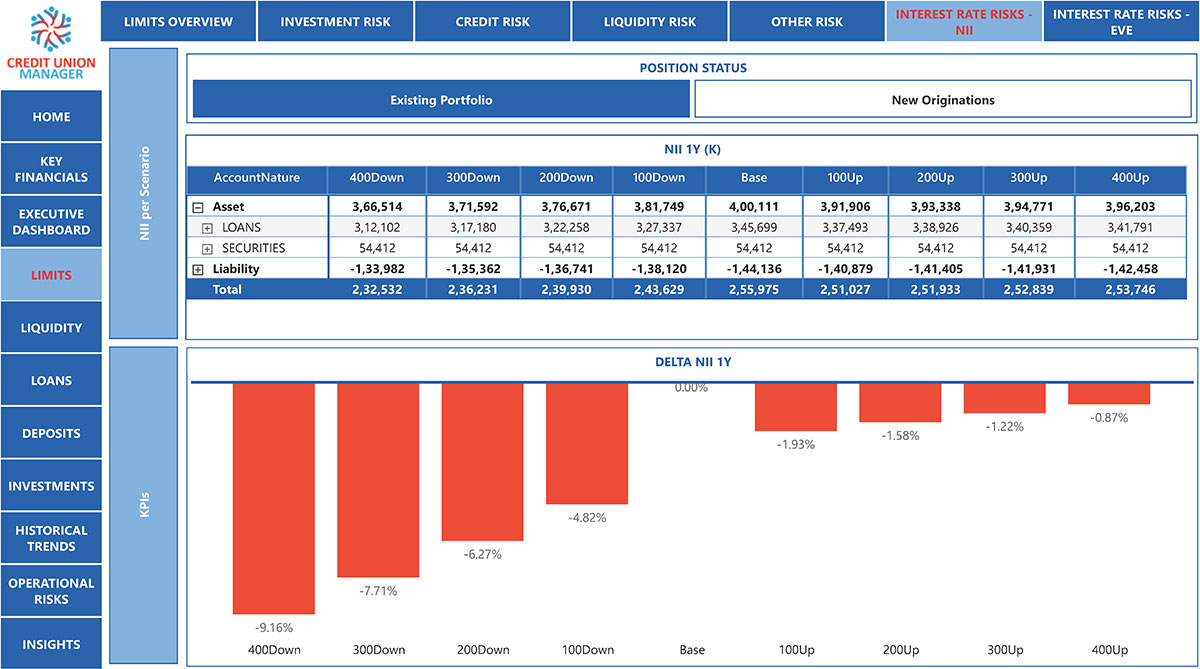

CURISK

UNIVERSAL RISK MANAGEMENT SYSTEM

- Quantifies strategic and board-level risk limits across scenarios

- Maps limits into dashboards with color-coded alerts (green, orange, red)

- Tailors modeling to specific risk frameworks and thresholds

- Displays proximity to risk violations in visual format

- Aligns scenario analysis with interest rate, economic, and business shifts

- Tracks limit adherence under real-time and forecasted conditions

- Enhances board reporting with intuitive risk visualizations

- Links strategic plans to corresponding risk tolerances

- Supports updates to risk frameworks based on evolving conditions

- Improves decision-making with forward-looking risk heatmaps