Optimizing ECL provision and CECL reporting for banks and credit unions

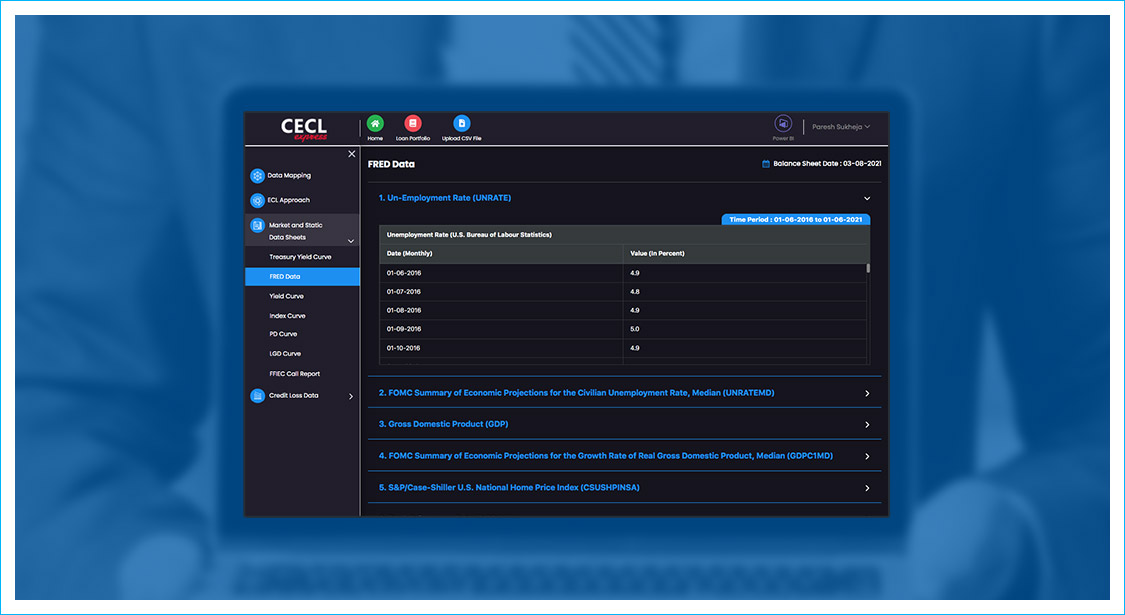

CECL Express is a cloud-based solution design that makes CECL compliance a business opportunity for smaller banks. Intuitive screen design, market data provision, and ECL optimization are all core features of the platform. The turnkey implementation with Finastra core systems means that it is also the easiest to implement.

- CECL Express is a cloud-based solution that provides banks with the ability to calculate their Expected Credit Loss (ECL) and optimize their Current Expected Credit Loss (CECL) provision and reporting.

- CECL is the accounting standard that all banks and credit unions must adhere to from January 2023. This date applies to smaller financial institutions as they were allowed two additional preparation years, compared with the larger filers.

- The new standard poses an extremely complex question to smaller banks. Potentially, without substantive history to base it on, they can estimate future losses from defaulting borrowers. In essence, banks are being told to conduct the type of sophisticated credit risk management that is associated with complex Tier I risk platforms.

- CECL reporting allows banks to utilize a variety of credit loss methods including – Vintage loan analysis (looking at the loss experience of similar loans in the bank’s past), Roll Rate (assuming current loss experiences in specific pools of loans continues as is), Discounted Cashflow Models (effectively using scenarios and loan ‘spreads’ to compute the implied expected losses), Weighted Average Remaining Maturity (similar to the Discounted Cashflow Model but using loan maturities to ‘weight’ the calculation), Probability of Default/Loss Given Default (using the likelihood of default and the recoverable amount to calculate the implied loss).

- Once the ECLs have been calculated, the bank must be able to defend the results, by exposing to audit, all the data and methods used. This alone requires an enormous effort from the IT department. Obtaining peer group data, curve data, and the macro-economic details for use and reporting of the results require ‘built for purpose’ data frameworks.

- Bringing the data and calculations together to report losses allows banks to be compliant and accurately report their CECL numbers. However, selecting the wrong methods for this exercise can lead to significant increases in capital to be held by the bank. A substantive increase in credit-related provisioning puts pressure on liquidity, profitability, and ultimately the business model of that institution.

- CECL Express is built to alleviate immense pressure on data, calculation methodologies, and audit requirements. By simply consuming a loan portfolio, the solution provides all market data from the FED, FRED, FFIEC, and NCUA. This allows valid results across multiple methods to be provided to the banks’ controllers. The system then provides options to optimize the result from the perspective of absolute cost and ECL volatility.

- CECL Express is easily linked to any loan management platform and has already been integrated with Finastra core systems including, LoanIQ, Phoenix, Ultra Data, and Credit Quest. The solution represents the most robust one, the most intuitive report screens, and the most efficient implementation. In short, CECL Express is the most complete CECL platform on the market.